How’s the Market? Q1 2024 Review of Seattle Area Real Estate

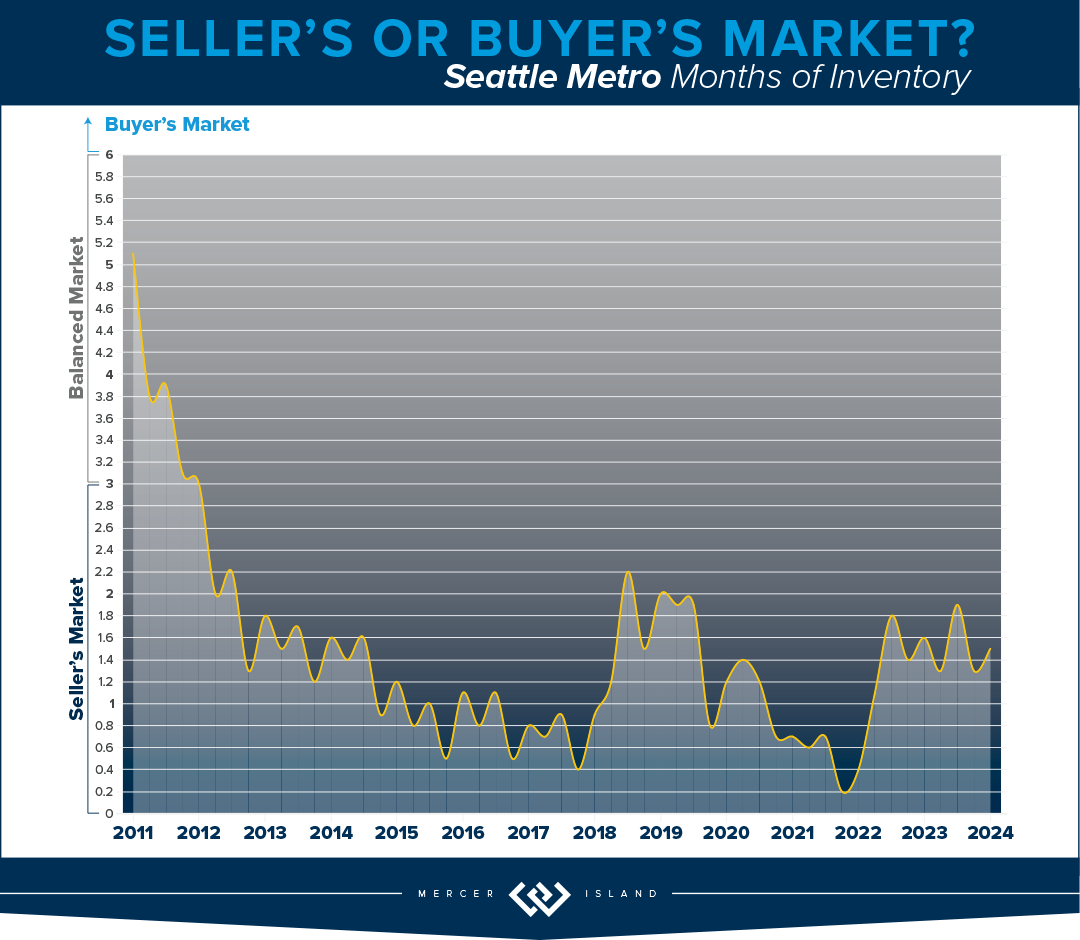

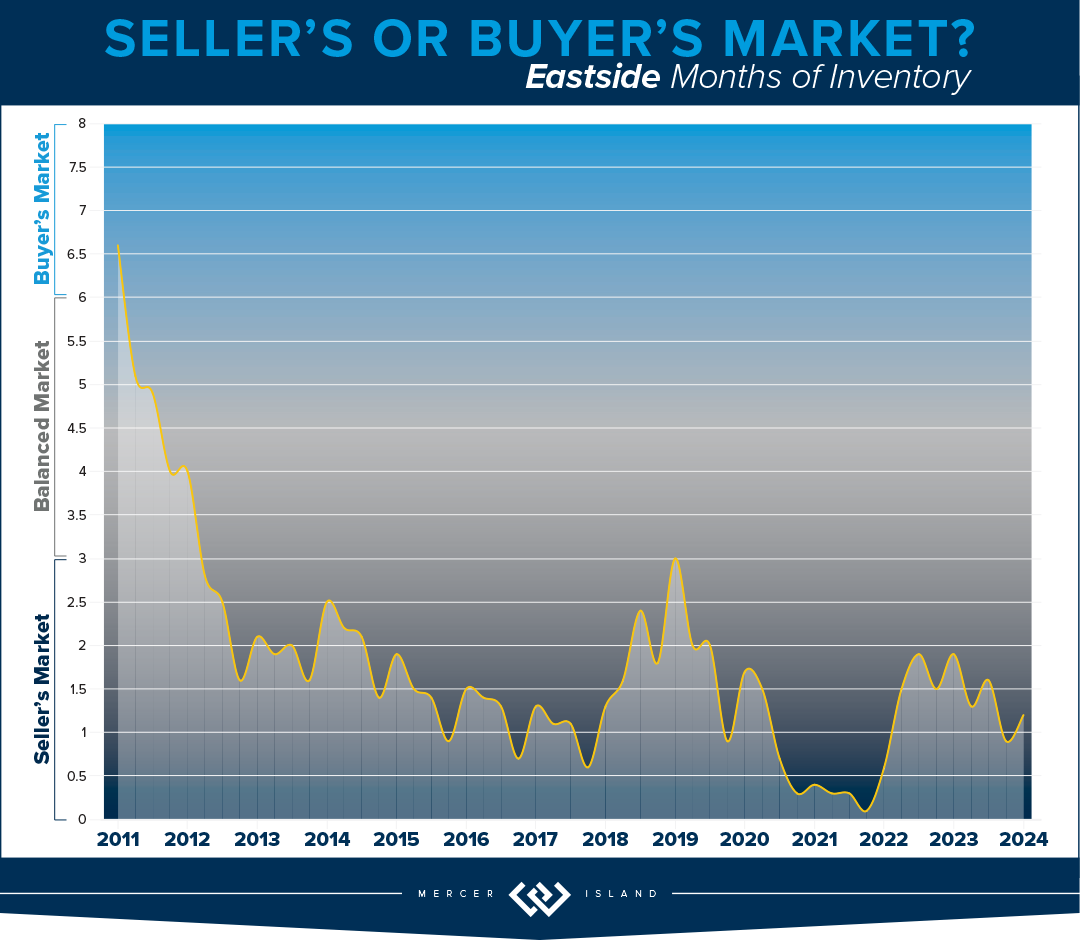

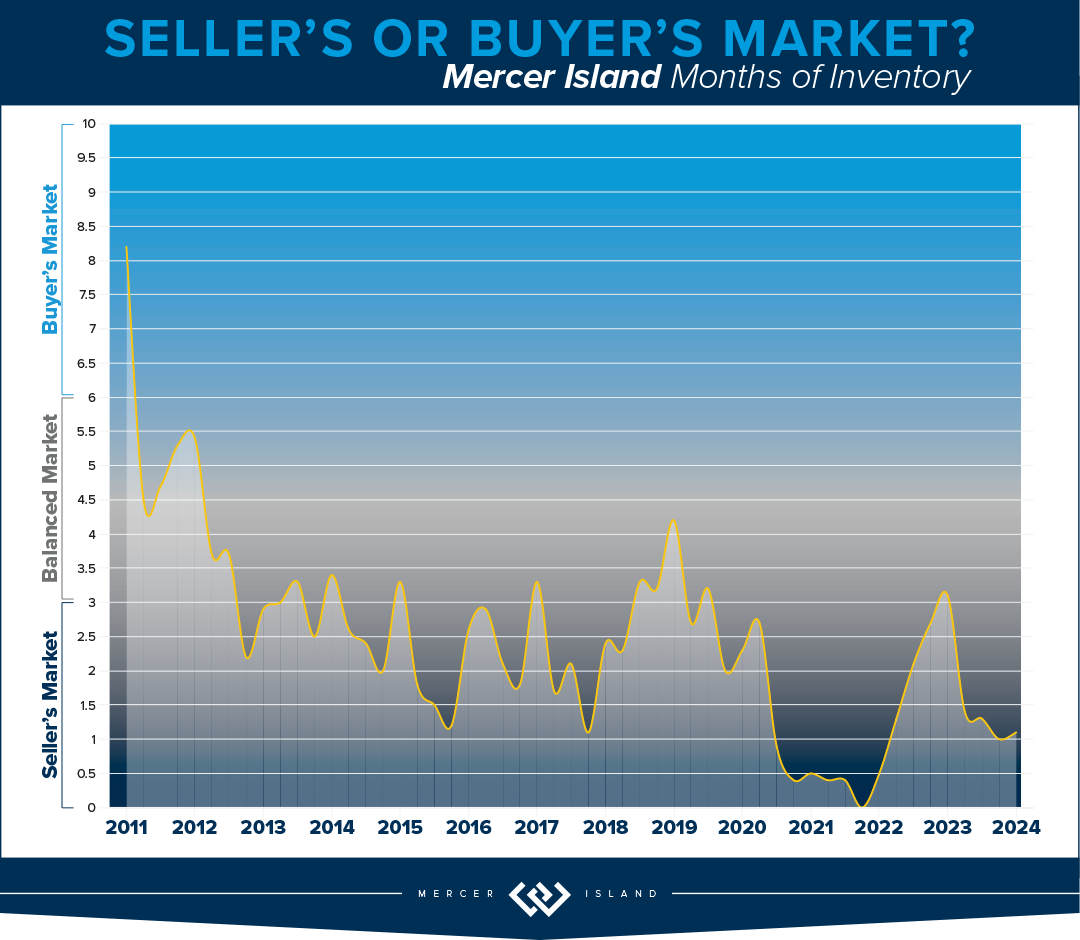

The Seattle/Eastside real estate market is hot and the Q1 stats support the claim; most homes sold in the first 10 days and either at or above their listed prices. Eastside median sales prices saw double-digit gains of 14% compared to this time last year, while Seattle was close behind with a 9% price bump. We saw more new listings this year than in Q1 of 2023; however, this was not enough to tip the scales and we remain staunchly in a seller’s market for the foreseeable future. The good news for buyers is that interest rates have stabilized and more sellers are jumping off the fence to list their homes. Competition for prime properties will remain high, however, so buyers should be prepared to take a leap of their own when the right home presents itself.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

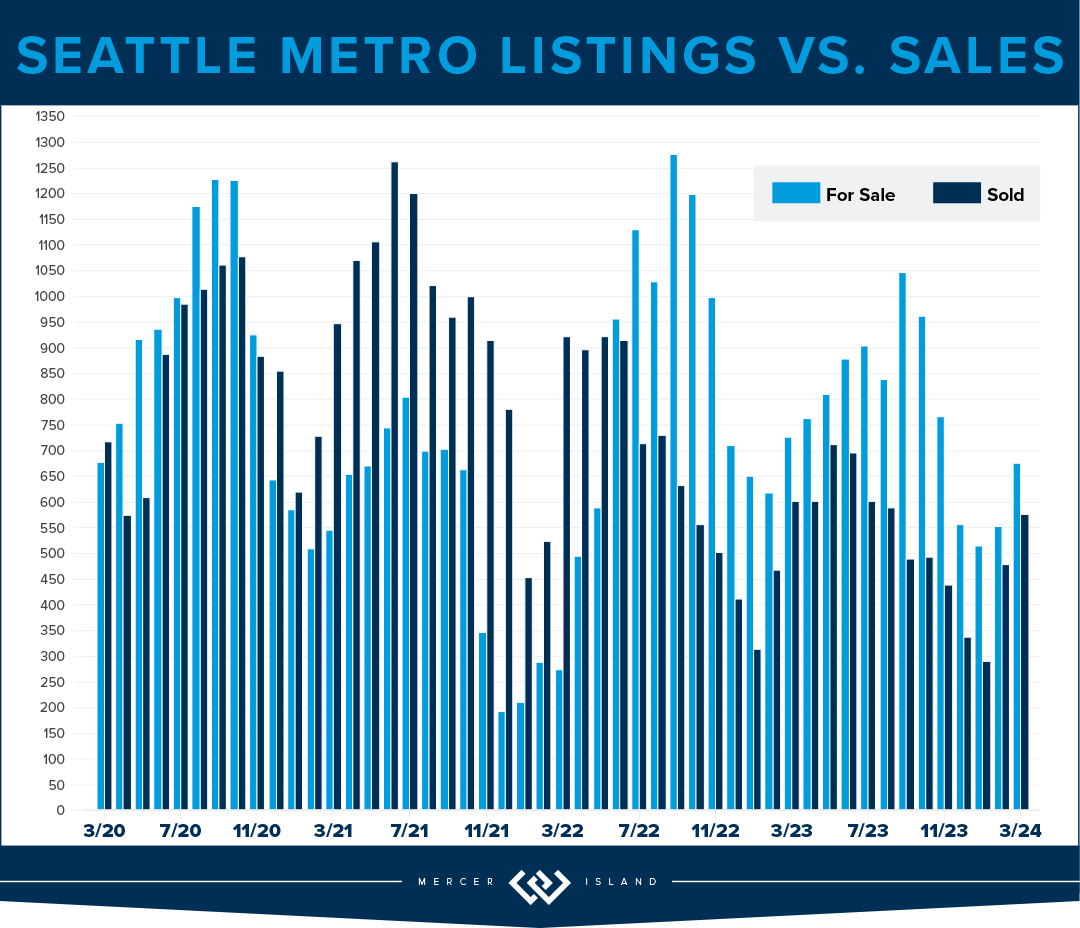

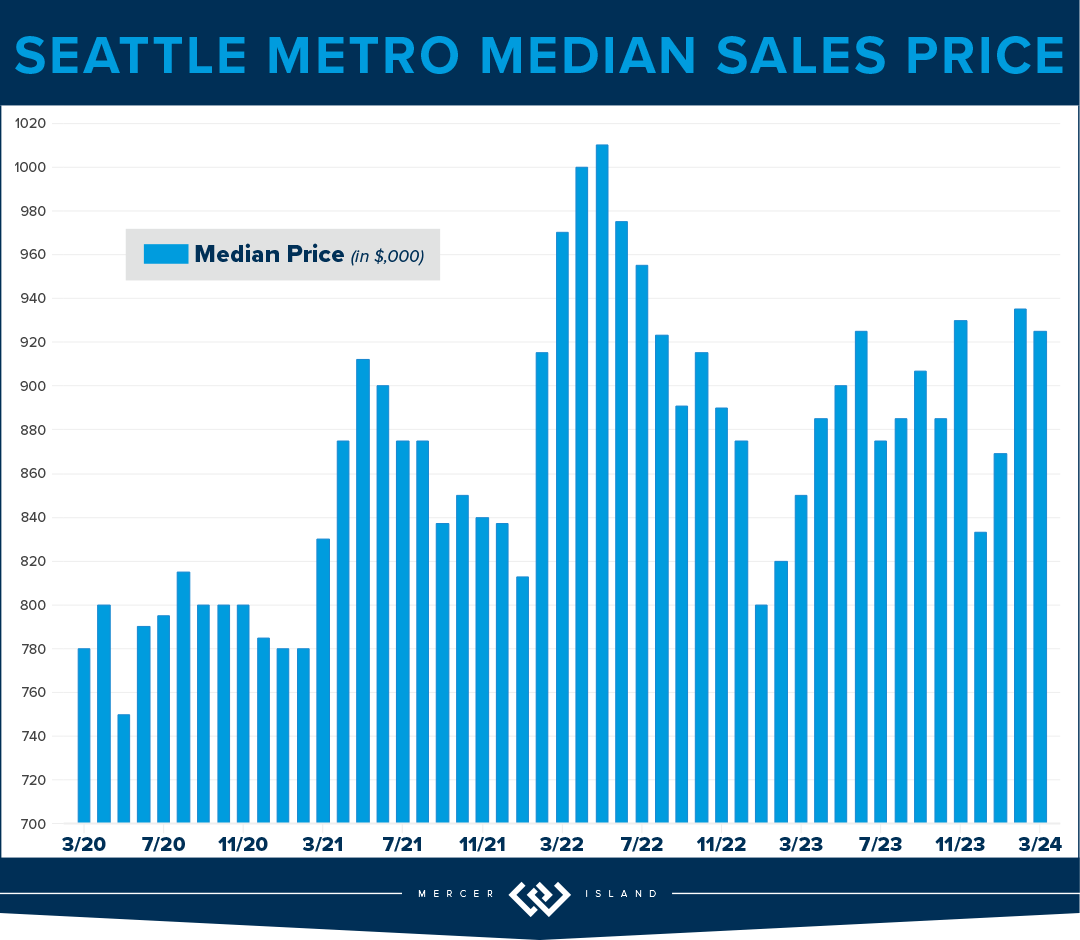

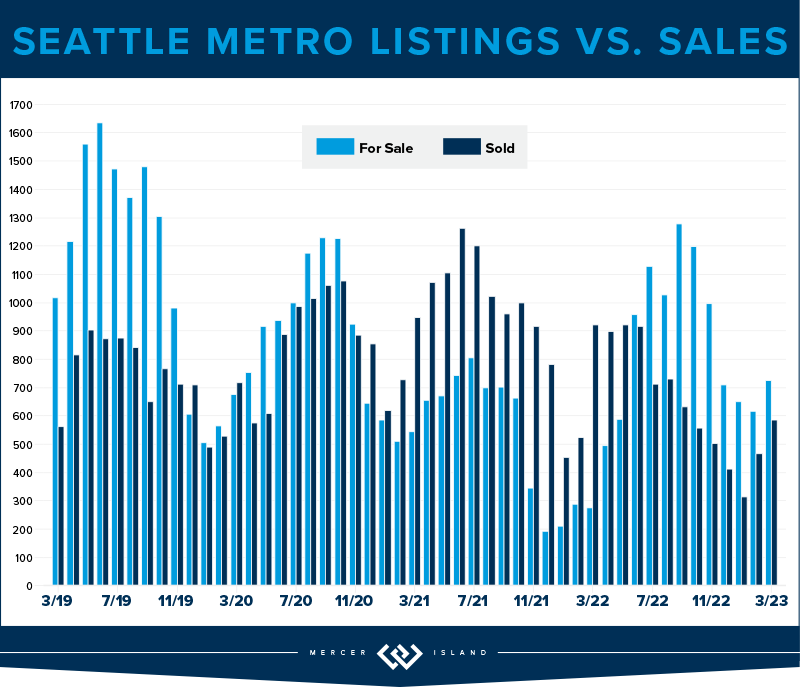

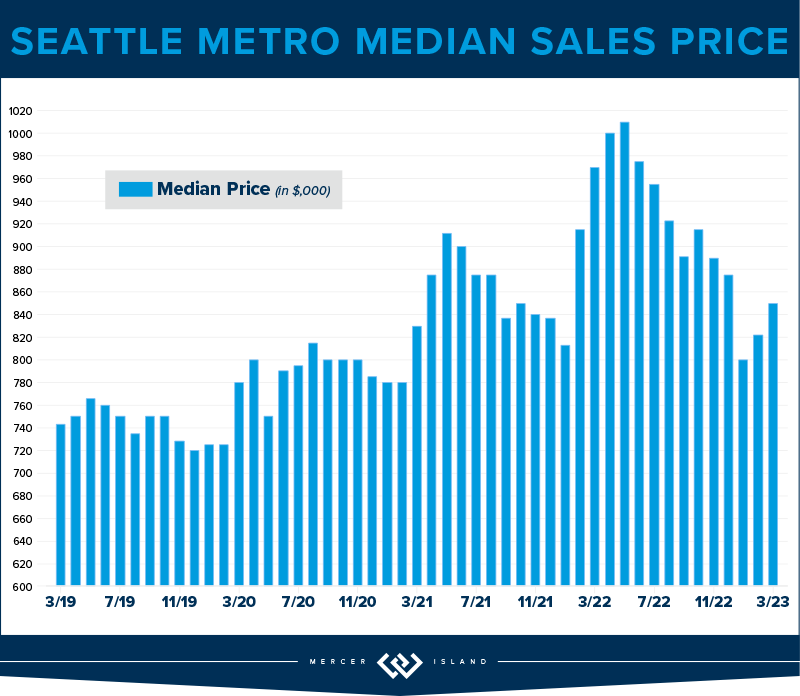

It’s safe to say the spring market hit early in Seattle! We’ve seen a 9% rise in median home price and 69% of listings selling at or above list price, all while interest rates are in the mid 6s. We are bullish on the year to come. Overall sales are down 3% YoY, which is slightly troubling because Q1 2023 saw a 28% dip from the previous year. If you dig a little deeper it seems that the north end (Kenmore and Lake Forest Park) saw a 42% reduction in overall sales with a 30% increase in median price.

Prices are up across the board. The largest jumps in median price are in Lake Forest Park and North Seattle (30% and 23% respectively), while the highest $/sq.ft. jumps were in Madison Park and South Seattle. 56% of all homes on the west side sold in the first 10 days and for an average of 105% of list price. This is a great indicator that the market will continue to be strong in Q2.

The total number of new listings remains relatively low in the city, when compared with years past. This is to be expected as current homeowners stay put to enjoy their cozy sub-3% interest rates. We hope that equity will begin burning holes in their pockets soon—the market could use the inventory. If you’ve been thinking about buying, this could be your year! Get pre-approved and be ready to jump when you see the right home come available.

If you’ve thought about selling your home, it may be a good year to do so. As is typical in the early stages of appreciating cycles, buyers are brought off the fence by “the house” popping up—and they’re paying premiums for cream puff properties. Interest rates have stabilized and experts say they may become even more favorable as the year progresses. Check with your agent about your own unique situation.

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

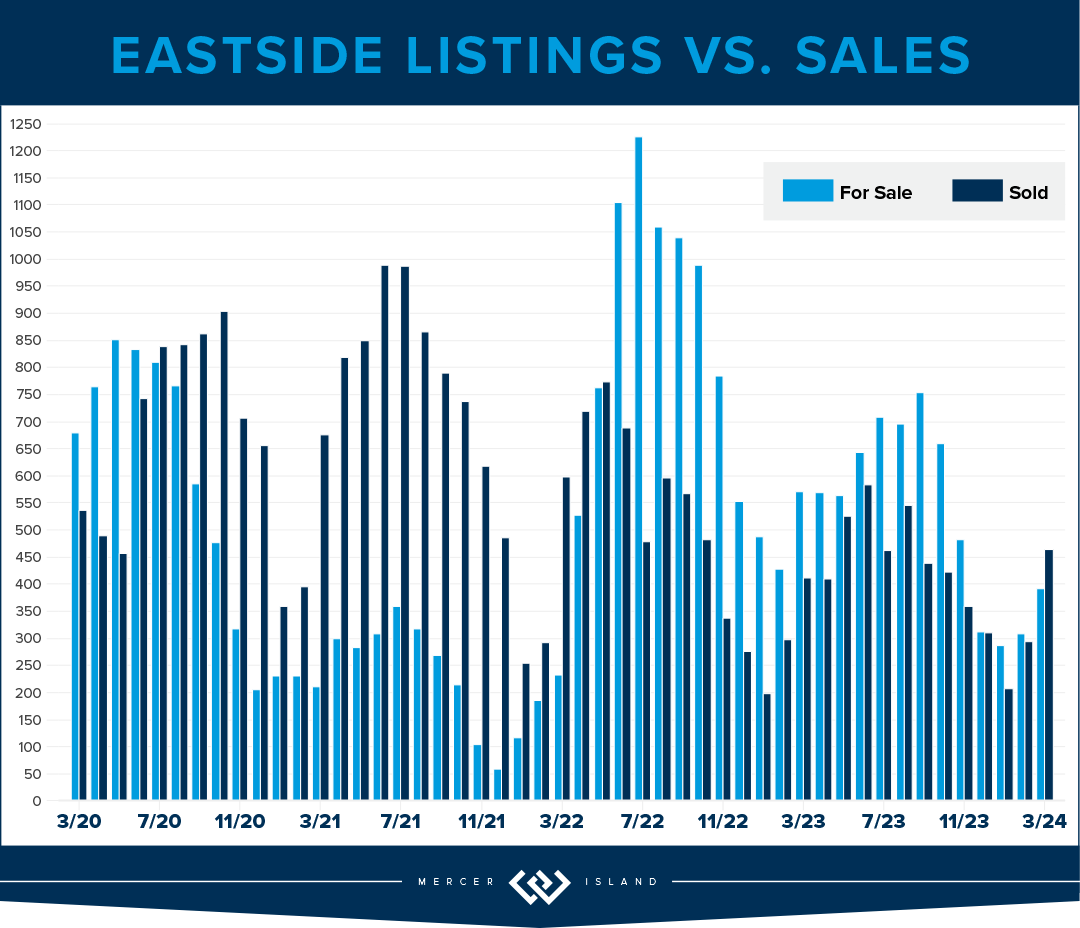

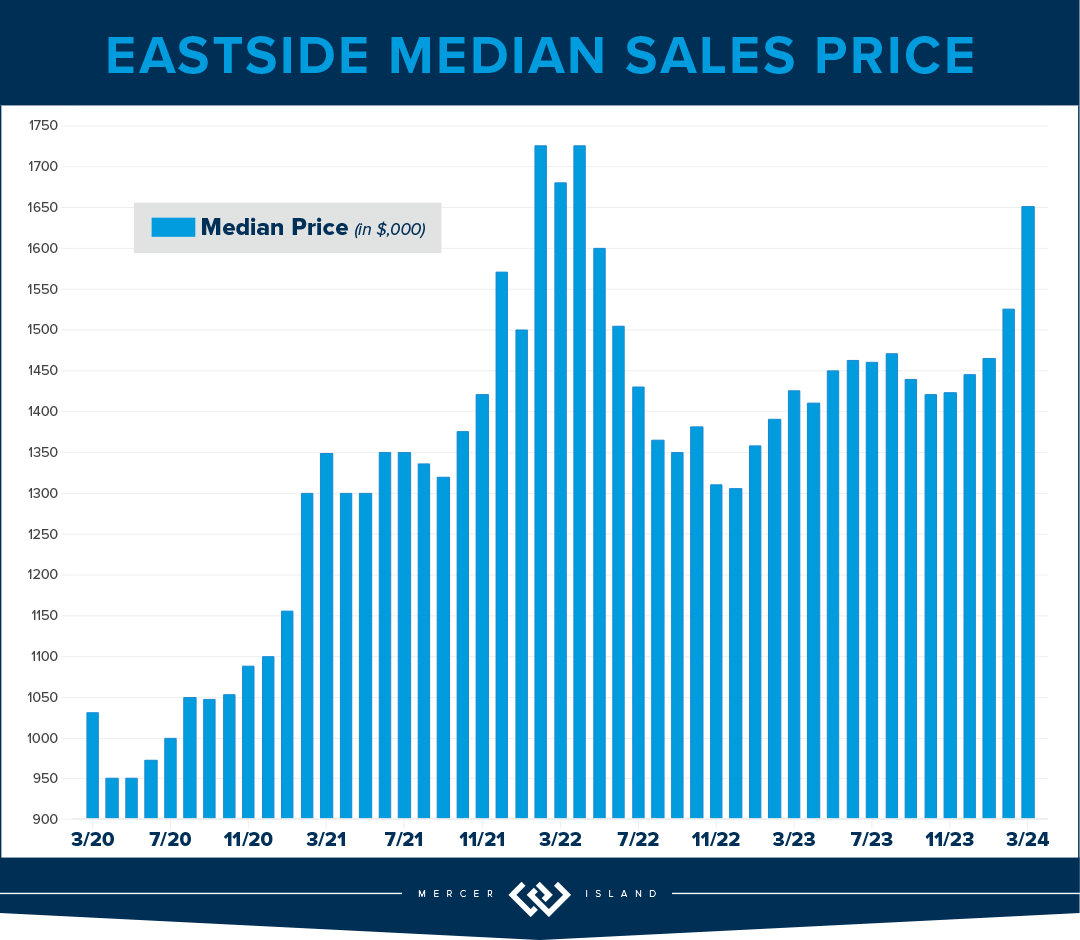

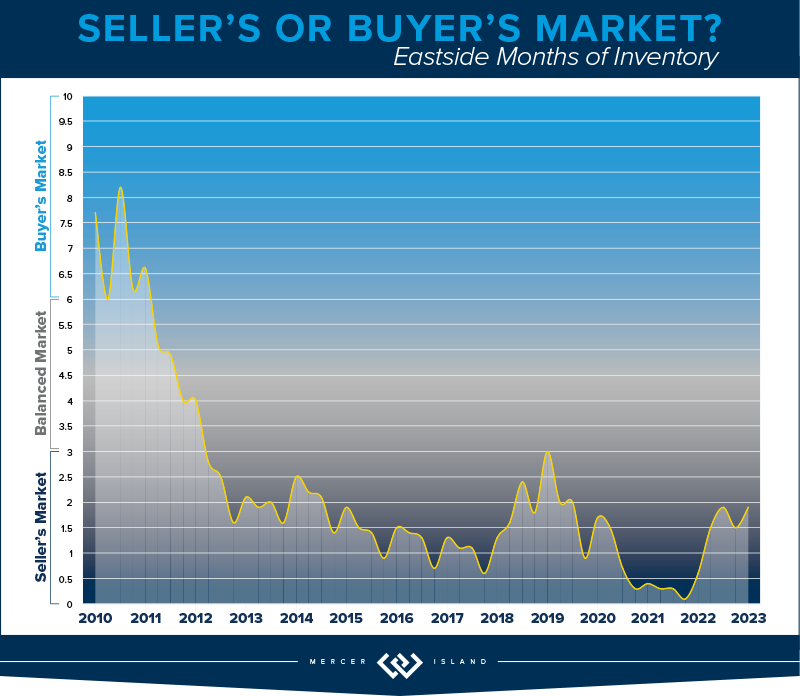

The numbers are in and the statistics reflect what agents and consumers have felt thus far in 2024—the market is hot. Median home prices on the greater Eastside are up 14%. 65% of all listed homes sold in the first ten days for an average of 105% of list price. The communities that have posted the largest gains are Kirkland and the area South of I-90 (32% and 21%). Redmond and West Bellevue reported much more conservative median price increases at 4%. The total number of pending homes was up 18% YoY, which bodes well for continued price gains.

If you’re in the market to purchase a home on the Eastside we are hopeful for more inventory this year. Even though rates are still nowhere near their all-time lows, which was the anecdotal explanation for lack of inventory in 2023, it seems that a Q1 sales boom is enough to help potential home sellers feel bullish on 2024. This means you can also expect competition for the prime properties. Our best home buying advice: do your research, act with confidence, and remember real estate is a long-term investment.

If you’re a homeowner thinking about a home sale in 2024, Q2 could be the perfect time. Shoppers are out in droves and they’re prepared to pay top dollar for quality product. The steep jump in median home price should continue at least into Q2. The only threat in Q3 and Q4 is what could shape up to be a distracting election cycle. Though, the election year is likely what is keeping downward pressure on rates. Our best home selling advice: follow your agents’ guidance on timing as it’s sure to be a volatile year. Prep hard and price conservatively. It will all work out in your favor.

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

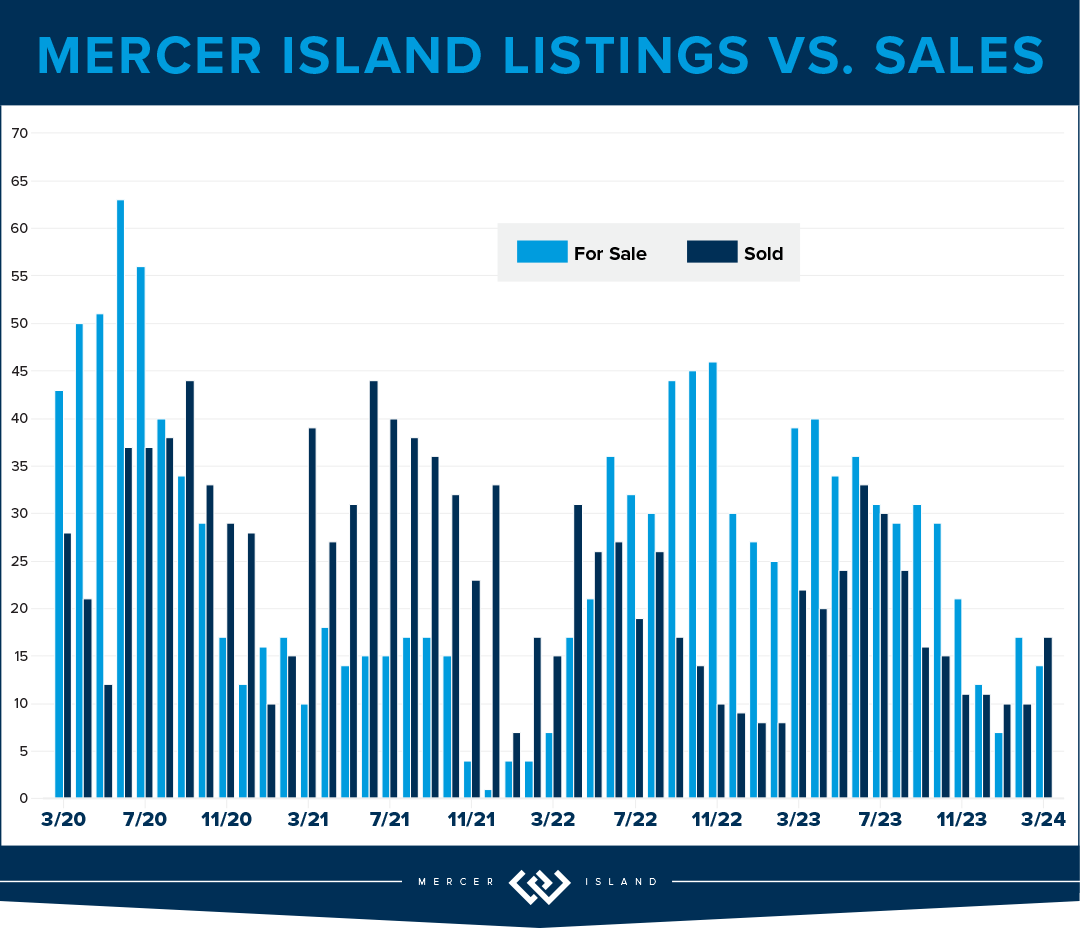

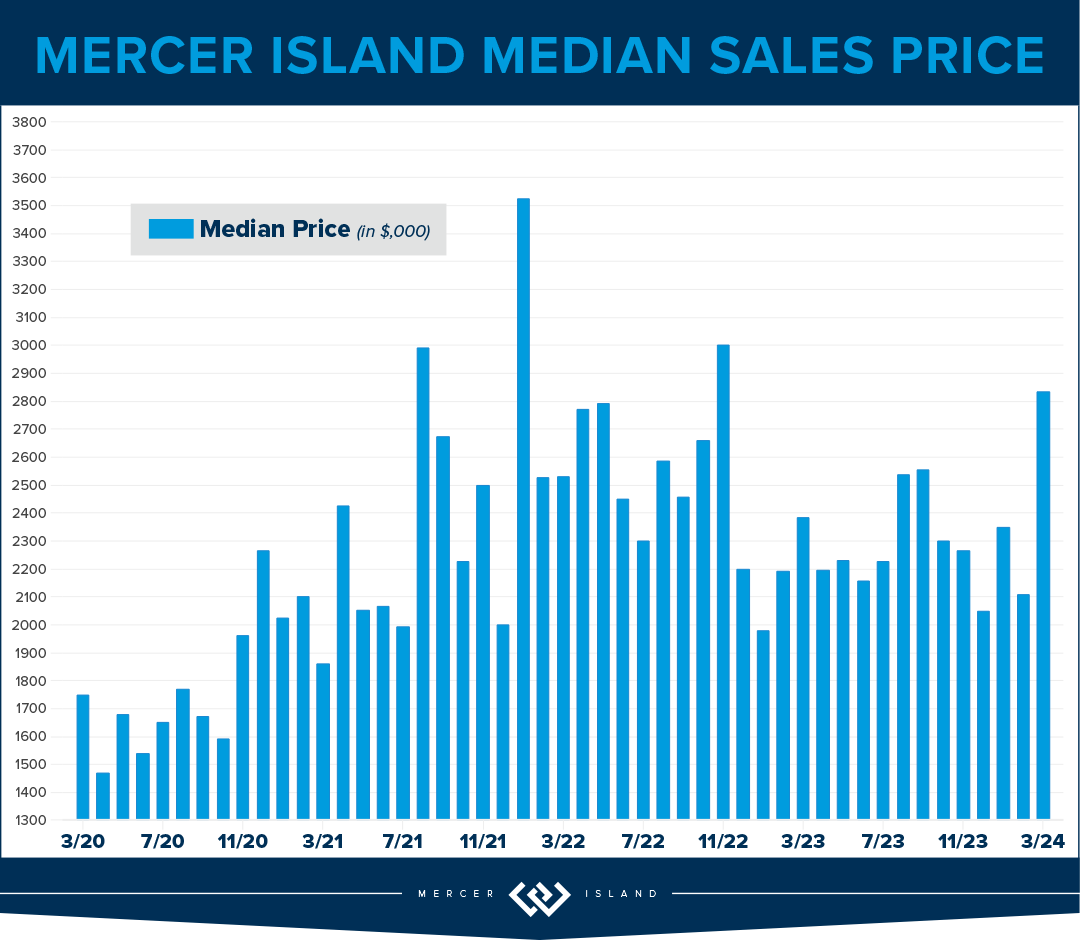

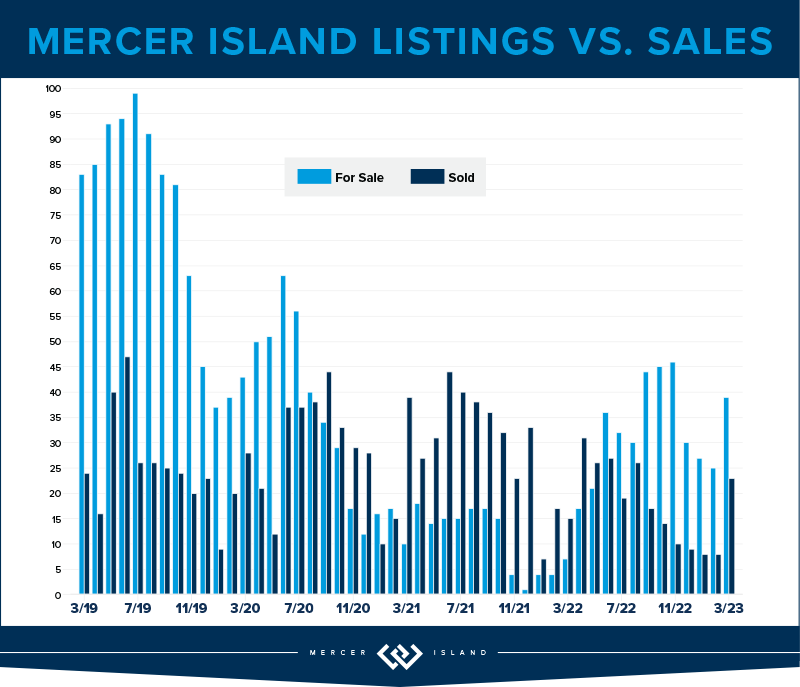

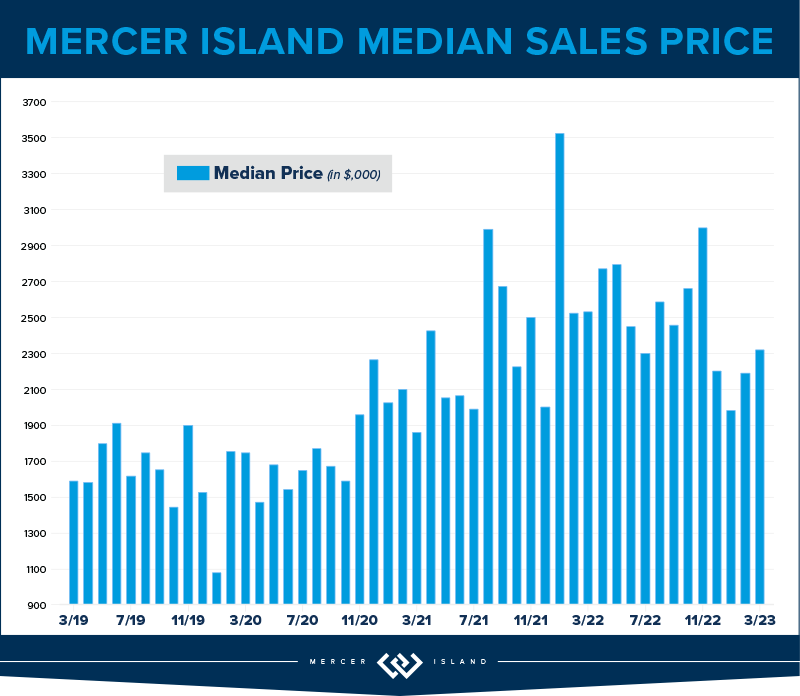

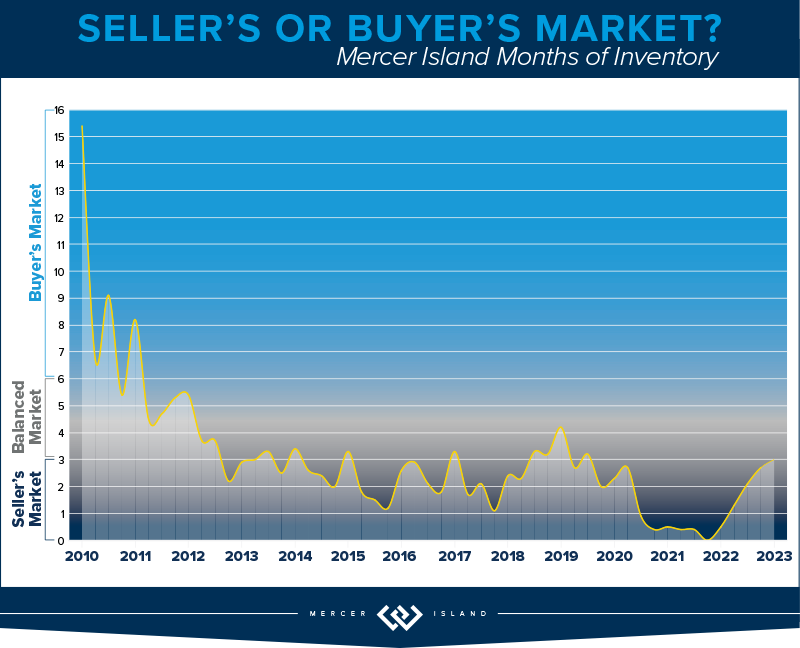

What a difference a year makes! In Q1, Mercer Island’s median sale price is already up 13% over a relatively flat year in 2023, rising from around $2,200,000 to $2,520,000. We’re seeing shorter market times and multiple offers; spring has sprung on the Island. With 59 new listings and 37 closed sales inventory appears to be tracking with what we’ve seen in Q1 in years past. That said, condos continue to lag behind single family: only 6 closed sales all quarter. The average price per square foot is $535—about where it’s been tracking since it jumped from $485 in Q1 of 2021. Not a lot of shocking change here.

If you’re in the market to purchase a home on Mercer Island you can expect better inventory this year than last year. Even though rates are still nowhere near their all-time lows, which was the anecdotal explanation for low inventory in 2023, it seems that a Q1 sales boom is enough to help potential home sellers feel bullish on 2024. This means you can also expect competition for the prime properties. Our advice: do your research, act with confidence, and remember real estate is a long-term investment.

If you’ve been thinking about selling your home to upgrade or downsize, Q2 could be the perfect time. Shoppers are out in droves and they’re prepared to pay top dollar for quality product. The steep jump in median home price should continue at least into Q2. The only threat in Q3 and Q4 is what could shape up to be a distracting election cycle. That being said, the election year is likely what is keeping downward pressure on rates. Our advice: follow your agents’ guidance on timing as the situation develops this year. Prep hard and price conservatively. It will all work out in your favor.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

It seems a healthy start to 2024 in the condo market. While the Q1 of 2023 numbers were down across the board, Q1 of 2024 is looking up with a combined rise in price of 15% and 34% more fresh new listings (YoY).

On the Eastside there were 202 active listings available at the end of the quarter, while 501 homes accepted offers during the quarter. This was the highest number of pendings in one quarter in the last two years! To real estate professionals, “pendings” are the canary in the coal mine of the market. A spike in pendings is a predictor that the market is heating up.

In Seattle new listings doubled from Q4 2023 (534) to Q1 2024 (1019), while pendings and solds are up 20% YoY. If you’re shopping for a condo, keep an eye out for enticing new inventory in Q2. 42% of Seattle condos sold in the first 10 days and for 100% of the list price. 44% of condos took more than 30 days to sell, though they still commanded 97% of their list price. To me this means that pricing is more important than ever in determining your outcome.

Now it’s time for me to stand on the home ownership soap box. There seem to be a lot of headlines about the unaffordability of single family homes. While there is no denying how expensive it is, there is a missing piece to the story: at some point during the prolonged period of “cheap money” first time buyers forgot about the first rung of the property ladder. CONDOS create an affordable option to start building wealth at a younger age. It’s an important real estate product that has been overlooked. We are hopeful that enterprising young homeowners return to the condo market in droves this next real estate cycle.

Check out area-by-area details the full condo report.

WATERFRONT

Seattle and the Eastside each had 6 waterfront sales in the first quarter, with 4 out of the 6 sales for both areas closing at or above the listing price (including one unlisted sale). All of the Eastside’s listed sales were on the market for only 8 days or less. Lake Sammamish was close behind with 5 sales (however 4 out 5 sales went below the asking price) and Mercer Island lagged behind with just 1 sale. Medina boasted the largest waterfront sale, a newer home on 117 feet of lakefront with a mind-blowing 13,590 interior square feet and 1.5 acres of grounds. The most modest sale was for a Lake Forest Park home on just 40 feet of waterfront—it sold almost immediately for 7% above its asking price.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2024, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Brooke Davis and Emerald City Snap. Eastside cover photo courtesy of Team RAREnorthwest and Clarity Northwest Photography. Mercer Island cover photo courtesy of Nancy LaVallee and Clarity Northwest Photography. Condo cover photo courtesy of Michael Fleming and Clarity Northwest Photography.

How’s the Market? Q1 2023 Review of Seattle Area Real Estate

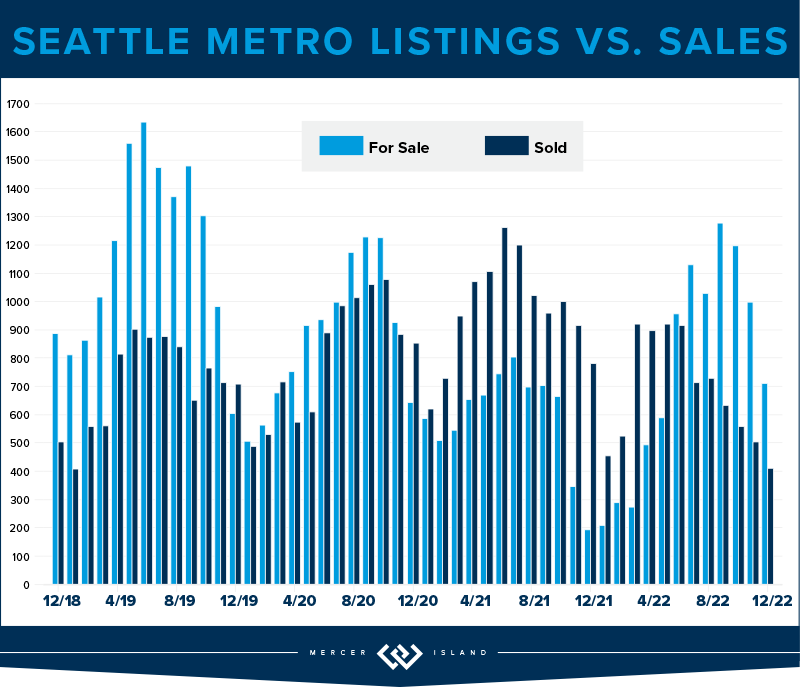

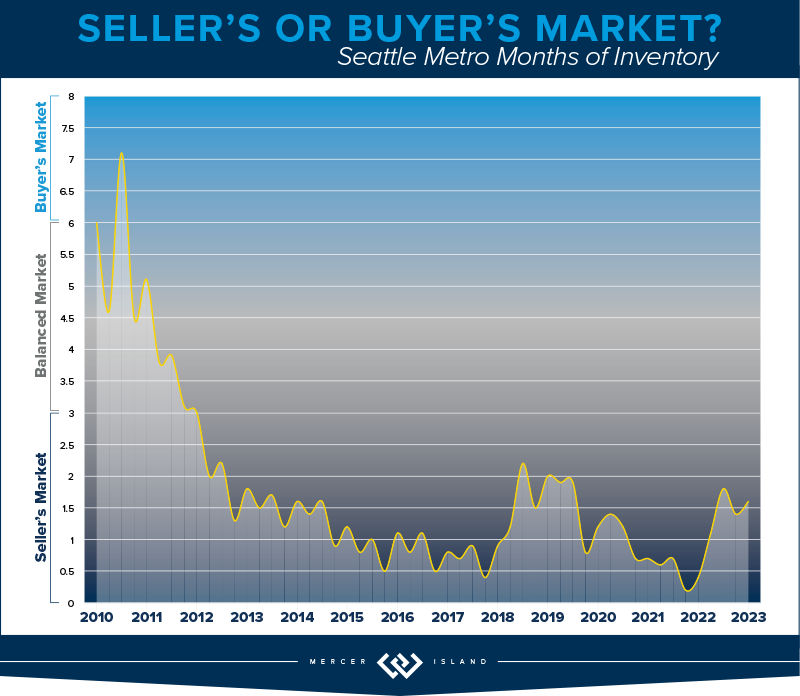

The first quarter of 2023 saw a price correction compared to last year’s spike, with year-over-year median prices down by 9% in Seattle and 14% on the Eastside. That being said, prices are already beginning to climb again with steady growth since the beginning of the year. Buyer demand remains strong despite higher interest rates—competitively priced, well-presented homes are still fetching multiple offers.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

For those who purchased a home in Seattle this quarter, it likely felt like there were more options and inventory with a minor rebalance on price. While transactions were down 28% year over year, we also saw median sales price was down from $925,000 to $830,000 since last quarter, which is a 9% adjustment. A down correction in pricing gave relief to buyers feeling the pinch and stress of rising interest rates to 6.5%. Rates have doubled the past 1.5 years but, considering the limited supply of homes for sale, the drop in home prices hasn’t been severe.

Neighborhoods like Lake Forest Park saw growth in their number of transactions (up 15%); other neighborhoods like Madison Park and Capitol Hill had nearly half the homes for sale compared to last year. It’s no surprise that as interest rates rise and affordability changes, buyers are casting a wider net to other parts of Seattle to the north. Keep an eye on neighborhoods like Shoreline, Kenmore and Lake Forest Park. Desirable prices paired with accessible transit is a bonus for those who are being asked to return to the office.

Multiple offers are apparent in some neighborhoods (price & presentation is key!) and we did experience 30% of homes sell above their listing price. If the shortage of inventory remains and interest rates drop slightly, we could see the frequency of multiple offers increase.

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

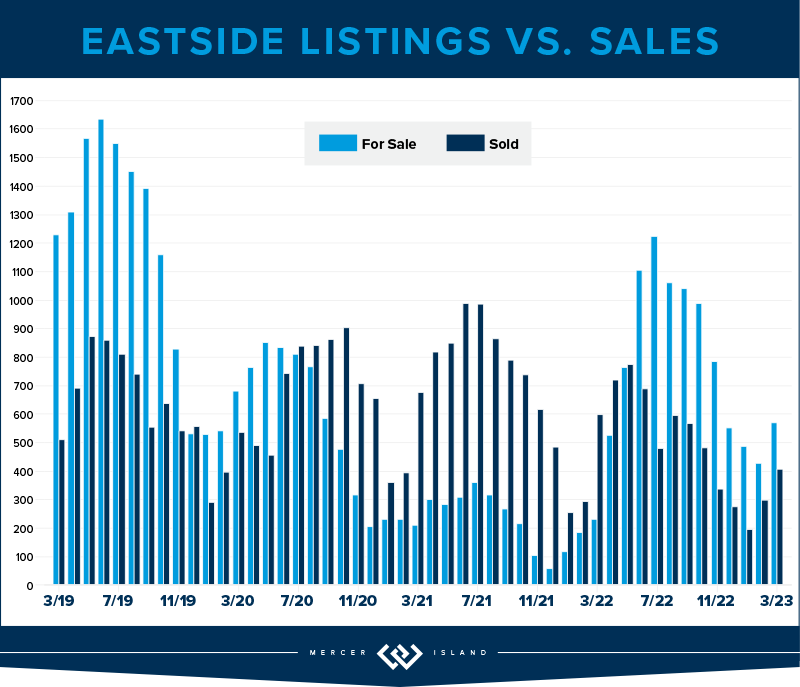

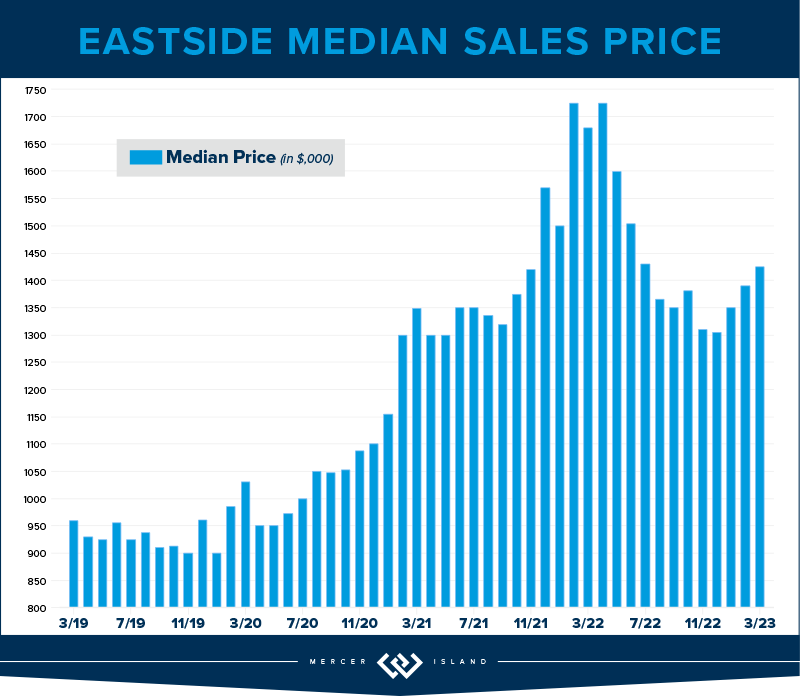

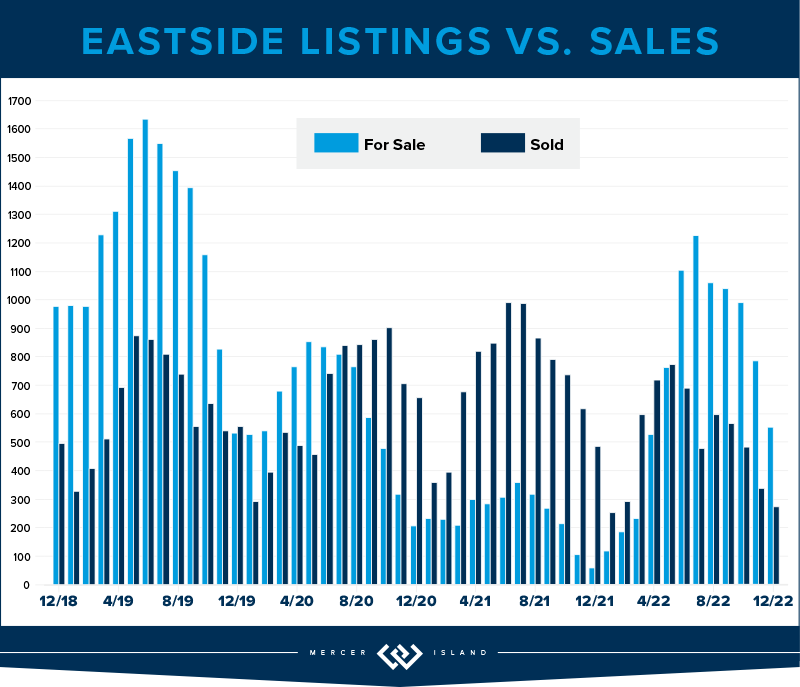

The Eastside was struck by job layoffs in the tech sector, rising interest rates and new property listings (28% more homes than last quarter!) but pending sales remained low compared to the previous year. Transaction volume was much like Seattle’s, with a decline of 22%. Mercer Island was the only community that stayed steady (no increase) in the number of transactions year over year.

Interestingly, while prices are down to a median of $1,400,000 year over year, this is a slight 2% increase from last quarter’s median of $1,380,000. 20% of the properties on the Eastside also sold above their listing price (most of these homes were in Bellevue) while sellers needed a shift in expectations with a whopping 58% of homes needing a price improvement to find their buyer. The list price vs. sold price percentage was 97% which means if you were a seller who listed your home at $1,000,000, you would expect to sell for $970,000 this quarter. Again, price and presentation matter and 41% of sellers who did this well sold in the first 10 days.

Buyers who are shopping for homes on the Eastside continue to be hyper focused on the school districts, turn-key properties and are serious about locking in their interest rate now, with the hopes of refinancing later this year when economists predict rates could decrease. If rates drop below 5.5% coupled with low inventory levels, we could see the frequency of multiple offers increase.

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

Even though there were just 39 residential transactions on Mercer Island this quarter, that number has stayed perfectly steady year over year. Over half of these homes sold in the first 10 days on the market, which is no surprise as demand has stayed robust.

13% of listings sold above their listing price, but this wasn’t concentrated on a certain community; four homes located on First Hill, Mid-Island plus the South & North Ends respectively, each received multiple offers this quarter. Q1 of 2022 saw a median price of $2,540,000 with just one home listed under $1,500,000. This quarter, the median price is $2,233,000 (a 12% decline) while six homes sold under $1,500,000! Due to the decline in prices and a slower start to the year, many sellers needed a shift in expectations with a whopping 67% of homes needing a price improvement to find their buyer.

We haven’t seen the number of new listings in the double-digit figures since Q2 of 2022, and it’s very possible we won’t experience that same level of inventory this year. Baby boomers are holding onto their homes with the benefit of their remarkably low 2.75% interest rate, and families are staying put to finish out the school year.

Our advice still stands: if you’re thinking about waiting for lower rates AND lower prices, you might be dreaming. Enjoy the fantastic Island inventory now, lock in your rate and consider refinancing later this year or next spring when economists predict rates will shift down.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Seeing first time homebuyers come back to the market or considering an investment? Buying a condo in Seattle or on the Eastside is a fantastic opportunity, especially as many companies are calling their employees back to the office at least 3 days per week. It’s very possible transaction volume will be up next quarter, but for now, transactions were down 44% year over year. With that said, 465 units sold in Seattle; 347 units sold on the Eastside which isn’t all doom and gloom.

Just like North Seattle is heating up with residential sales, Lake Forest Park, Shoreline, Ballard and North Seattle condos outpace the rest of Seattle, up 10% on average. These areas are experiencing new construction townhomes that are especially desirable to first time homebuyers. Boutique builders are offering a trendy design palette (have you seen the Scandinavian-style design with light woods and sleek finishes?) paired with all the “bells and whistles” that city dwellers appreciate, like dog washing stations, artificial turf, and EV chargers.

For the Eastside, Redmond condos stayed the steadiest, down just 17% year or year. Kirkland was the only neighborhood to experience a price bump, up 11% to a median price of $693,000.

The Seattle condo median price has declined just 1% year over year to $515,000, while the Eastside experienced a 12% adjustment to $550,000. This is a $530,000 average when comparing both areas. With interest rates doubling the past 1.5 years and buyers considering a condo unit under the umbrella of a condo association, shoppers will be very particular about their monthly dues assessment and what’s included for those monies as both interest rates and dues have such a dominant effect on their overall buying power. Condos continue to be a necessary niche in our marketplace!

Check out area-by-area details the full condo report.

WATERFRONT

There were 17 privately-owned waterfront home sales in the greater Seattle-Eastside region in Q1 2023 (Eastside-7; Seattle-6; Lake Sammamish-2; Mercer Island-2). This is exactly on par with last year, when we also saw 17 sales in Q1 2022.

The highest sale was for a Medina Northwest Contemporary on 115 feet of low-bank waterfront that sold above list price for $20m. The most affordable waterfront was a unique triplex with 1920-1930 era beach cottages on a private boardwalk near the Ballard Locks—a buyer snagged it below list price for $1.9m.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

© Copyright 2023, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Mercer Island cover photo courtesy of Petra Varney and Clarity Northwest Photography.

How’s the Market? Annual Review of Seattle Area Real Estate

While 2022 began on the heels of an extreme seller’s market we saw in the wake of the COVID pandemic, the second half of the year showed a marked shift back toward normalcy. Rising interest rates and tech layoffs significantly slowed down the number of home sales. The good news for buyers is that we finally saw a rise in the number of homes for sale (although we’re still not back up to our pre-pandemic inventory level).

Our Chief Economist, Matthew Gardner, predicts that median home prices will continue to pull back from their 2022 spike, but will then resume a more normal level of appreciation once interest rates stabilize. You can find his full forecast here.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

The Seattle real estate market seems to be out to prove the old “tortoise and the hare” fable. The tale the numbers are telling is that when you don’t boom big, you’re likely not to bust big. 2022 was a year of steady growth and a lot less fear than in surrounding cities.

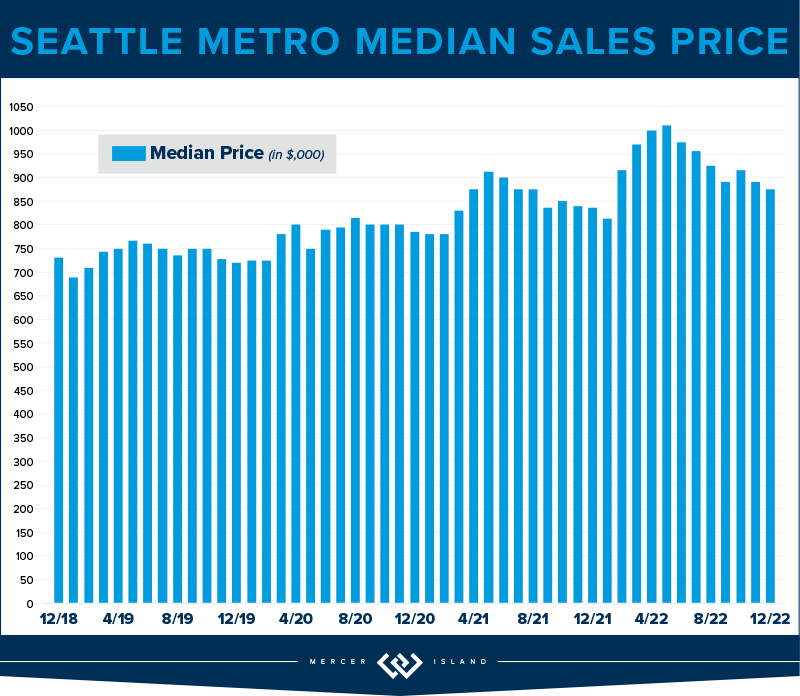

On average in a 2022 total look back, Seattle’s median price was up 10% (to $940,000) over $852,000 in 2021. Most of this gain was realized in the first half of the year, and unfortunately eroded in the second half of the year—when combined, it paints a fairly clear picture that we’re back to a “normal” market coming into 2023.

Queen Anne-Magnolia (up 17%), West Seattle (up 14%) and the Central District (up 13%) all fared better than average. Kenmore hung in at a 6% gain, which, given the volatility of interest rates and speculation, is still a respectable number for the year!

The headline for this year is that overall transaction volume was down in a big way. In Seattle, there were a total of 8,173 homes that sold; this is down 30% from the 11,670 sales we saw the year before. The slower market is not, however, creating a climate of fear where homeowners jump to cash out at the peak. New listings for the year were down a total of 13%.

We’ll be watching closely in 2023. If consumer confidence builds with the stabilization of interest rates, we’re going to have an even larger inventory crisis than we’ve faced in years past.

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

Finally, it’s safe to say that balance and normalcy have returned to the Eastside real estate market. The irony is: now that we’re in a balanced market, which is what homebuyers have purported to crave for a long time, the buyer’s appetite to purchase has all but dried up; overall transaction volume was down 36% in 2022 (5,448 sales vs. 8,569 in 2021).

If any of you are considering a move in the next 5 years, NOW is the time. The pendulum has swung back in the buyer’s favor: home inspections, negotiations and contingencies are all prevalent. We may not be at the exact “bottom” of pricing, but interest rates have stabilized, there are good homes for sale, and competition amongst buyers is rare. This is IT!

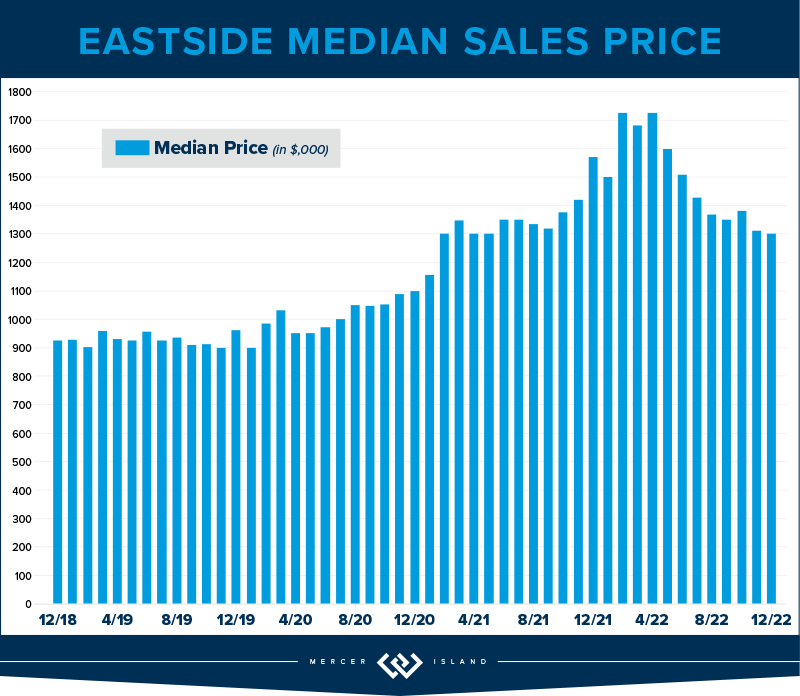

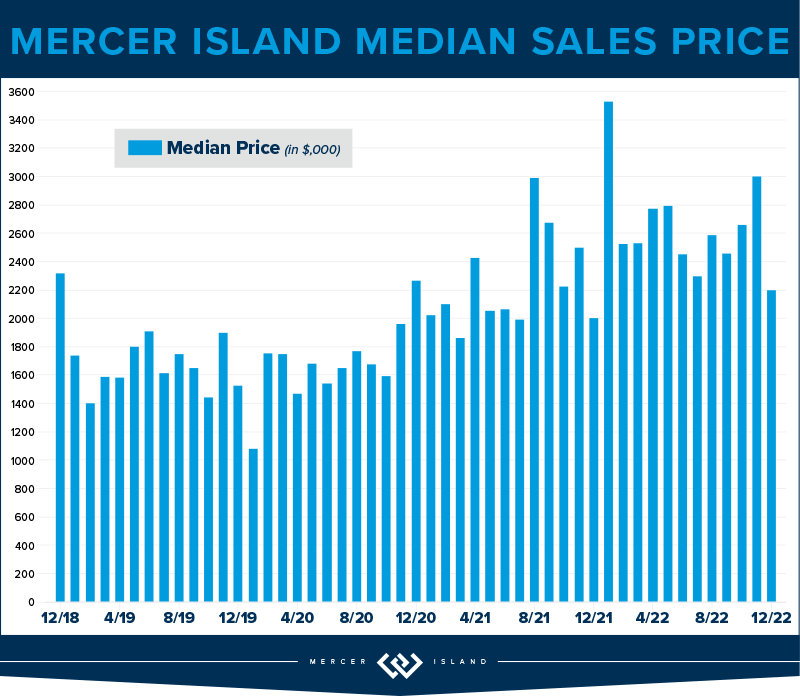

The Eastside’s Median Sale Price was $1,525,000 in 2022, up 14% over 2021’s unbelievable 30%+ gain ($1,350,000). Woodinville rules the day at a 17% rise, followed closely by Mercer Island (+16%) and Bellevue (both East and West at +15%).

While the market is slower paced, we are not in dire straits. This is thanks to a continued lack of inventory (down 5% YOY), and the amount of equity built in 2020 and 2021. Home sellers will spend the year working to determine the best way to attract a buyer. Price, preparation and timing will all play an important role. Home shoppers are sure to revel in their day in the sun!

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

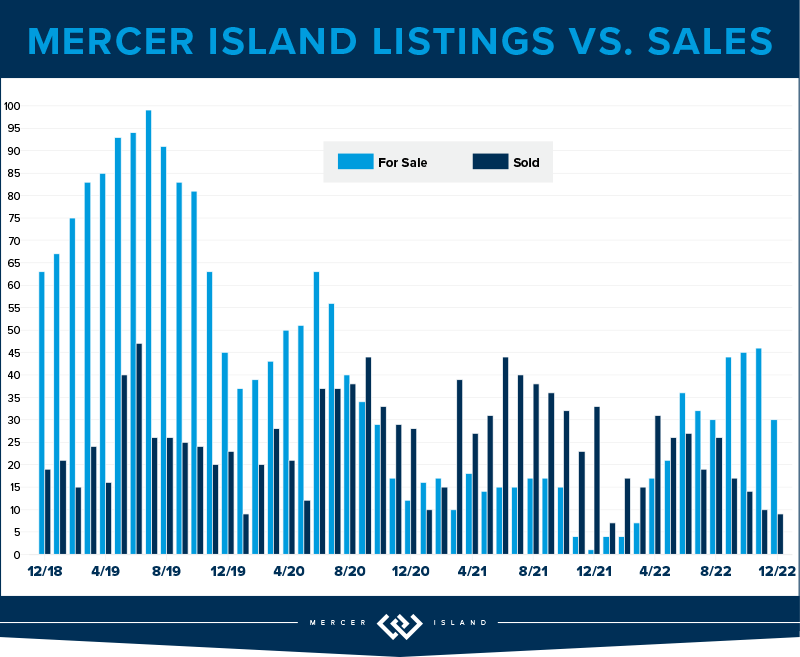

Mercer Island was once again its own unique micro-market within the Pacific Northwest. Total sales volume was only 209 homes, down 46% from 2021. This means that of nearly 10,000 households on the Island, only 2% purchased/sold a home.

The pace of sales was affected not only by interest rate volatility but also by the local tech economy/job market. The median home price nevertheless held strong with a 16% rise over 2021, even with the price correction that we all started to feel mid-year.

Buyers have decided to sit on the sidelines while it all shakes out, but home-owners on Mercer Island are not running for the hills. They’re patiently waiting (often without adjusting their asking prices) for the demand to return. It seems to be working: the median list price to median sales price ratio ROSE in 2022 from 77% to 88%.

2023 should be a solid year for Mercer Island real estate. All the pieces are in place: community pride, great schools and easy transportation. Let’s see if the upward trend continues!

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Seattle condos saw a Median Sale Price increase of 6% (to $520,000) and Eastside condos saw a 13% increase (to $620,000) in 2022. 53% of Seattle condos and 67% of Eastside condos sold in the first ten days on the market. This growth is larger than what we saw in 2021, which hopefully is some good news to anyone thinking of selling a condo in 2023. It seems that demand for urban living may be returning.

66% of Seattle condos and 77% of Eastside condos sold at or above their listed price. Those listings that sold in the first 10 days on the market went for an average of 1% and 4% above their list price, respectively..

On the Seattle side, Shoreline and Lake Forest Park condos saw about a 20% increase—and on the Eastside, Sammamish and East Bellevue condos carried the day with 19% and 23% increases—in Median Sale Price.

Overall, condos get our award for “ones to watch.” They remain a bright spot in terms of affordability when compared to single family homes, especially on the Eastside. Compare the $620,000 median sale price of a condo to the $1,525,000 median home price and it’s clear condos are a great first rung of the property ladder that might get attention in 2023.

Check out area-by-area details the full condo report.

WATERFRONT

There were 93 privately-owned waterfront home sales in the greater Seattle-Eastside region in 2022 (Eastside-32; Seattle-36; Lake Sammamish-15; Mercer Island-10). This is down significantly from the banner year in 2021 when we saw a whopping 170 total sales.

This truly is a market with geographic limitations. With such a high volume of sales in 2021 and a relatively strong 2022, we expect 2023 to be more conservative. Our late-2022 market shift from an extreme seller’s market to a more balanced level of supply and demand coincided with the close of the waterfront selling season. This means pricing will be tricky this season as we explore uncharted waters. More than ever, real estate experts will be essential to analyze the data and consult their spidey-senses to find the price that will attract a buyer in this new normal.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

© Copyright 2023, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed.

How’s the Market? Q3 2022 Real Estate Review

While still considered a seller’s market, our July-September home sale activity signaled the return of some much-needed balance. Seattle and Eastside home prices still posted year-over-year gains in Q3, but rising interest rates markedly slowed the pace of both listings and sales. Houses also stayed on the market longer than we saw during the frenzy earlier this year—the average Seattle home took 17 days to sell, while Eastside homes averaged 25 days to sell. Buyers have a great opportunity to negotiate better terms now with an eye out to refinance when interest rates come down in the future.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

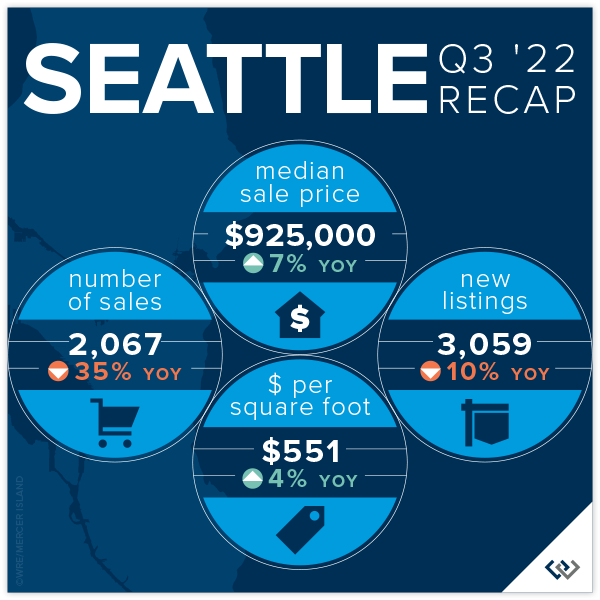

SEATTLE

There is a lot of good news in Seattle these days: Progress is being made in taking back downtown, the West Seattle Bridge is open AND real estate prices are UP year over year.

Transaction volume is down 35% across the city, which we can likely attribute to the volatility in interest rates, but listing volume is also down 10%. This is comforting! Supply and demand rules the market, and the last thing this balancing market needs is more inventory. We think this drop in seller enthusiasm is likely caused by the golden handcuffs of their historically low interest rates and refinance boom: even if your home isn’t meeting your needs these days, that 2.75% interest rate might be hard to give up.

Seattle’s average list/sold price ratio is 97%. This means if you listed your home for $1,000,000 you could expect to sell for $970,000 in Q3 of this year. Compare this with 82% on the Eastside. Seattle home sellers are more realistic and less affected by the price bloat of the last several years. We didn’t boom as hard, and we may not feel the impacts of a market balance as sharply either.

Click here for the full report and neighborhood-by-neighborhood statistics!

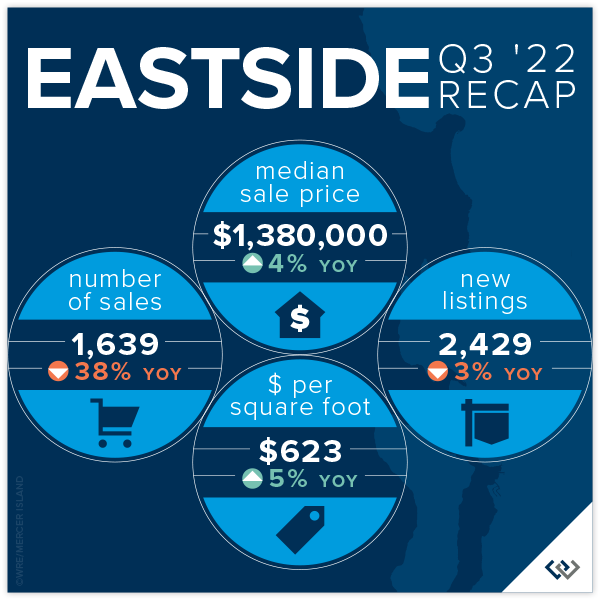

EASTSIDE

While we’re finally seeing the numbers reflect what the market has been feeling since May, it’s not as dire as one might think. Sales volume has slowed 38% year over year (based on total transaction count). However, new listings are also down (3%) which means the market reaching its peak has not sparked a sell off. This should keep our new normal buzzing along at pace similar to 2018 and 2019. Great homes that are priced right will sell—21% of homes sold above asking price and 40% of homes sold in the first 10 days.

Median list price is down 6% while median sales price is down 14.5%, which means homeowners looking to sell on the Eastside now have some data points to help them with realistic expectations of how to find the market. Average days on market is 25, which is higher than it’s been since Q1 of 2020! This is still slightly under the 6-year average. Don’t be tempted to think that there is something wrong with a home just because it has been on the market for a month; there are a lot of quality homes ready for their new owners.

The news of the day is interest rates. Heavy volatility in the markets and the administration’s drive to stem inflation have caused many buyers to pull out of the market. If you’re thinking you’ll wait for lower rates AND lower prices, you might be dreaming—if rates come down next year as predicted it will likely spur activity on. Our best advice: THIS is the market you’ve been waiting for. As a buyer you have choice, time and negotiating power for the first time since 2018. Capitalize! Then, refinance later.

Click here for the full report and neighborhood-by-neighborhood statistics!

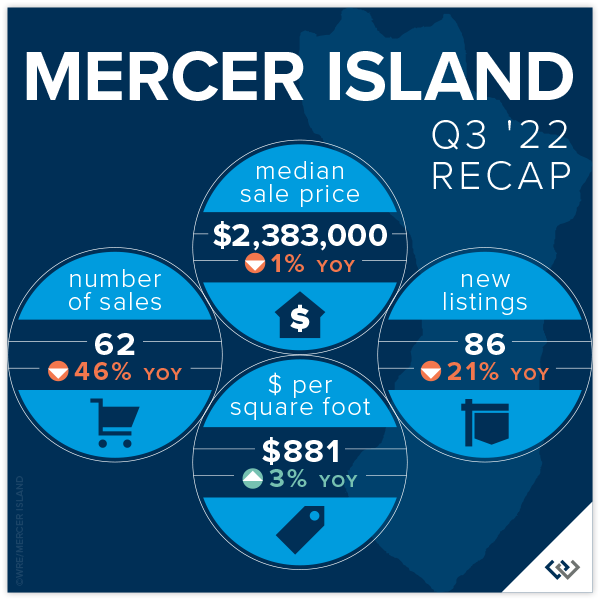

MERCER ISLAND

Given the broader local news, we might expect doom and gloom from Q3 stats—this expert sees lots of opportunity and much needed stabilization after the crazy COVID boom. While median prices have fallen 1% year over year, the average price per square foot is actually UP. What does this mean? Comparing a median with an average is always a little tricky, but this likely points to a slowdown in the sale of larger homes.

To me, the better signs of market predictability are the months supply of inventory for the quarter (about 6 weeks for both condos and single family) and the average days on market (18 for sf and 57 for condo). These are all relatively healthy benchmarks, even though they’re markedly higher than in previous quarters. This is what’s causing media to report doom and gloom: inventory is up sharply (there was ONE active listing at the end of Q4 2021 vs 44 at the end of Q3 2022) and pending sales are down (57 vs. 94 last year in the same time period). When you compare our current numbers to any time period outside of the last two years, we’re faring very well!

The news of the day is interest rates. Heavy volatility in the markets and the administration’s drive to stem inflation have caused many buyers to pull out of the market. If you’re thinking you’ll wait for lower rates AND lower prices, you might be dreaming—if rates come down next year as predicted it will likely spur activity on. Our best advice: THIS is the market you’ve been waiting for. As a buyer you have choice, time and negotiating power for the first time since 2018. Capitalize! Then, refinance later.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Condos remain the tortoise as opposed to the hare like residential markets of 2020-early 2022. Slow and steady will definitely win this race as the affordability of homeownership shrinks with rising interest rates. Looking at combined condo data (Eastside + Seattle), months supply of inventory is down to about 6 weeks from 2 months last quarter. Low months supply of inventory and low cumulative days on market (23) are two of the leading indicators of market health, and both are as low or lower as they’ve been in the recent past.

Condo prices are also holding strong with no change to the average $ per square foot in Seattle and an overall 5% rise in median sale price year over year. The Eastside tells an even slightly better story: a 9% rise in $ per square foot and a 6% rise in median sale price despite a 41% year-over-year drop in the number of transactions.

Keep rooting for the tortoise. This is a necessary niche in our marketplace. The first rung on the property ladder is condos again for the first time in a long time, and we really hope our Gen Z and Millennial buyers take the leap!

Check out area-by-area details the full condo report.

WATERFRONT

The most affordable place to buy waterfront this quarter was Beach Dr in West Seattle at a closed sale price of $1,800,000 for 22’ of waterfront on an 11,000 sq. ft. lot. The largest piece of shoreline overall was 172 feet in Medina on Lake Washington, which commanded a sales price of $17,800,000.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis provided by a savvy broker with years of local waterfront experience.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2022, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and deemed accurate but not guaranteed.

How’s the Market? Q2 Real Estate Review

While Seattle and the Eastside are still considered a seller’s market, buyers experienced some much-needed relief in the second quarter with new listings outpacing the number of homes sold. Rising interest rates have initiated a shift toward a more balanced market. Opportunities abound for both sellers (who are still seeing higher sales prices than this time last year) and buyers (who finally have some breathing room to negotiate price and contingencies). We expect this shift to continue with a stabilization of home prices rather than the steep upward trajectory we saw last year.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

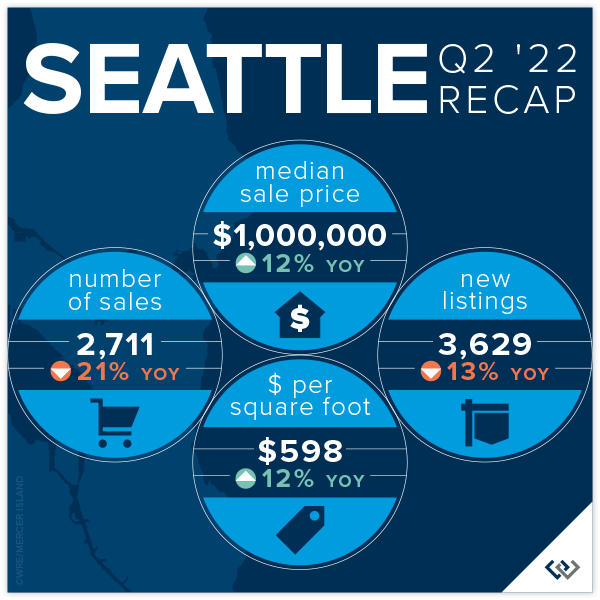

SEATTLE

The Seattle real estate market for single family homes is holding steady despite rising interest rates and slowdowns elsewhere in King County! The median sale price is up 9% since the end of 2021 (from $910,000 to $1,000,000). Year over year, the median price rose from $895,000 in Q2 2021 to $1,000,000 in Q2 2022 (also roughly 12%).

Anecdotally, we believe that Seattle continues to gain ground because it remains affordable when compared to the cities and neighborhoods to the east. Eastside median prices rose so sharply over the last two years that it left Seattle “in the dust” as the market leader of the region. As we know, slow and steady wins the race, though there is no way to know yet if this particular race is a marathon or a sprint.

Interest rates nearly doubled in Q2, though that seems to leave Seattle home shoppers undeterred. 86% of the sales in Q2 sold in the first 10 days at an average of 110% of list price.

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

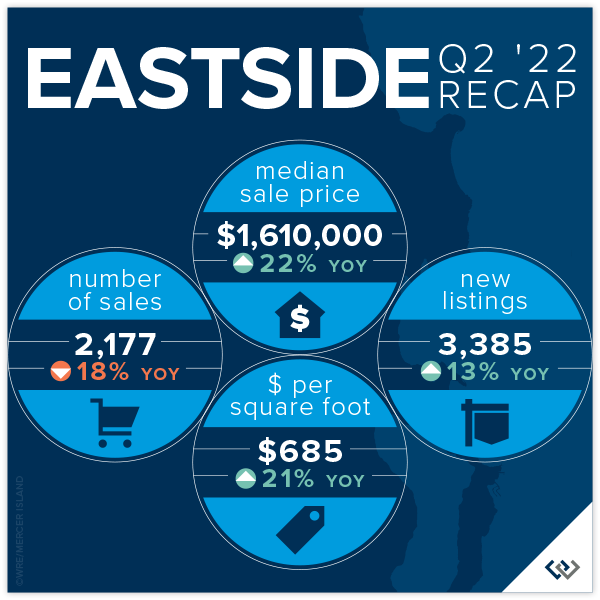

Relief has finally come to home shoppers on the Eastside! New listings are up 13% year over year. Further, there has been a slide in total number of sales, down 18% year over year. This means there are more choices for anyone who is in the market to buy a home. Price gains remain steady for now, up 22% over Q2 of 2021. This is likely riding the wave of growth in late 2021 and early 2022, but with the higher supply and lower demand this is may be a trend that tapers off in the near future.

Average price per square foot saw its first quarterly drop since Q2 of 2019, down from $713 in Q1 to $685. The overall median price fell from a high of $1,625,000 in Q1 to $1,610,000 in Q2. Even more exciting for home buyers is that (when in competition) the list to sales price ratio is 109%— down from 119% in Q1.

If you’ve thought about selling your home, it’s still a great time. When a home is prepared well and priced right shoppers pay attention. Of the 2177 homes sold in Q2, 84% of those sold in the first 10 days. This isn’t far off of the 90% that was posted in Q1. It is harder to get noticed today than in recent memory—this is where choosing a true professional to partner with is so important! Windermere brokers have their fingers on the pulse and know how to make you stand out in a crowd!

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

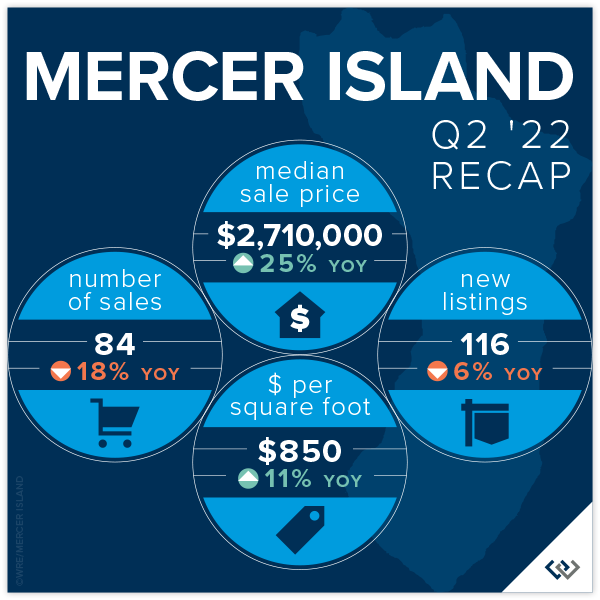

Mercer Island continues to be a fabulous place to be a homeowner. Median prices and price per square foot both saw increases over Q1 2022 numbers (6.5% and 5% respectively). Anecdotally, there has been a pace change. We don’t expect that to reflect in the stats until Q3, and even then the numbers are likely to be favorable as we gained so much ground in Q1 of this year.

The data that supports what we’re all feeling can be found in the relationship between number of new listings and number of homes sold. In Q2, there were 116 new listings and 84 sales compared to the same period in 2021 when we had 124 new listings and 102 sales. So, if you’re feeling like inventory is “up,” it’s not because more homeowners are deciding to sell but rather it appears that demand is down. Another way to look at this is that we sold 82% of the active inventory in spring of 2021 but only 72% in 2022. These are healthy numbers but it’s enough of a drop for us to feel it.

If you’re a buyer trying to break in to the Mercer Island market, it’s getting easier. 83% of the 116 new listings sold within the first 10 days for an average of 111% of the asking price. This is the most favorable these numbers have been since 2019. Working with a local pro will be your biggest advantage to determine which homes will sell at a premium and how to get the best deal!

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Condo average prices have seen their biggest quarterly rise since Q3 of 2016! As home shoppers adjust expectations amidst rising interest rates, the affordability offered by condos is an exciting place to turn. We are thrilled to see condos be a viable option as we recover from the pandemic and buyers return to more densely populated areas.

North Seattle (up 34%) and Capitol Hill (up 10%) are bright spots in the total number of condos sold year over year for Seattle. This makes perfect sense as both areas offer access to our growing light rail system and new retail opportunities that didn’t exist pre-pandemic. Seattle’s total sales year over year remained flat, literally zero, which means these two neighborhoods carried the entire city.

The same data point on the Eastside saw the entire area’s total number of sales fall 27% year over year. West Bellevue (down 51%) and Mercer Island (down 38%) topped the list. Meanwhile, prices on the Eastside are up an average of 20%.

Check out area-by-area details the full condo report.

WATERFRONT

Waterfront season is heating up. As expected, inventory is up from Q1 (32 total sales in Q2 v 17 in Q1), but what hasn’t changed is an average of only 6 listings for sale at any one time across all shorelines! Of all of the waterfront shorelines, Mercer Island boasted the lowest days on market with an average of just THREE days. Seattle had the highest days on market, with an average of 41 days.

The most affordable place to buy waterfront this quarter was Beach Dr in West Seattle at a closed sale price of $1,800,000 for 25’ of waterfront on a 17,000 sq. ft. lot. The largest piece of shoreline overall was 177 feet in Issaquah on Lake Sammamish, which commanded a sales price of $11,600,000.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis provided by a savvy broker with years of local waterfront experience.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2022, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and deemed accurate but not guaranteed.

Seattle & Eastside Farmers Markets: Locations, Times & More

Summer is just around the corner, and so are these farmers markets! Spend an evening or weekend finding your new favorites among the tents. Think it’s all about kale? Think again. Most offer live entertainment along with a mouth-watering variety of local brews, cheese, bread, meat/seafood, honey, hand roasted coffee, and other hidden gems (in addition to the freshly picked fruits & veggies). This year, we’re proud to sponsor the Mercer Island Farmers Market for its 15th season!

Seattle Metro

- Ballard

- Capitol Hill (Broadway)

- Columbia City

- Lake City

- Lake Forest Park

- Madrona

- Magnolia

- Phinney

- Pike Place

- Queen Anne

- Shoreline

- U-District

- Wallingford

- West Seattle

Greater Eastside

- Bellevue – Crossroads

- Bellevue – Downtown

- Carnation

- Duvall

- Issaquah

- Kirkland – Downtown

- Kirkland – Juanita

- Mercer Island (Sponsored by Windermere MI!)

- North Bend

- Redmond

- Renton

- Sammamish

- Woodinville

Seattle Metro

Ballard

Seattle’s first year-round Farmers Market, selling produce exclusively from Washington state farmers along the historic cobblestone stretch of Ballard Ave.

Sundays, 9am – 2pm | Year-Round

5345 Ballard Ave NW | Seattle

sfmamarkets.com/visit-ballard-farmers-market/

Photo courtesy of sfmamarkets.com

Capitol Hill (Broadway)

Come for Sunday brunch from food vendors who source ingredients from local, WA state farms (many of whom you’ll also meet selling their wares at the market). Live music and street performers often make an appearance, too.

Sundays, 11am – 3pm | Year-Round

E Barbara Bailey Way | Seattle

seattlefarmersmarkets.org/chfm

Photo courtesy of do206.com

Columbia City

With everything from freshly harvested Asian greens to Ethiopian eats, come check out the immense variety King County’s most diverse zip code has to offer. Bring your bounty to adjacent Columbia Park for a picnic.

Wednesdays, 3pm – 7pm | May 4 – Oct 12, 2022

37th Ave S | Seattle

seattlefarmersmarkets.org/ccfm

Photo courtesy of SouthSeattleEmerald.com

Lake City

This celebrated North End seasonal market offers unique finds grown and prepared by local farms and food artisans. Enjoy kids’ activities, too!

Thursdays, 3pm – 7pm | June 16 – Oct 6, 2022

NE 125th St & 28th Ave NE | Seattle

seattlefarmersmarkets.org/lcfm

Photo courtesy of enjoylakecity.org

Lake Forest Park

With an emphasis on fresh, locally grown food, this market is an epicurean’s delight. Browse hard cider, baked goods, preserves, meat, pasta, sauces, and prepared foods along with the locally harvested fruits and veggies. There is also one “Crafts Market” each summer featuring local artisans.

Sundays, 10am – 2pm | May 8 – Oct 16, 2022

17171 Bothell Way NE | Lake Forest Park

www.thirdplacecommons.org/farmers-market

Photo courtesy of www.thirdplacecommons.org

Madrona

Located in one of Seattle’s most diverse neighborhoods, you’ll find artisan foods as well as seasonal produce from Washington state farmers, fishers, and ranchers.

Fridays, 3pm – 7pm | May 13 – Oct 21, 2022

MLK Way & E Union St | Seattle

sfmamarkets.com/madrona-farmers-market

Photo courtesy of sfmamarkets.com

Magnolia

This popular Saturday market is nestled in the tree-lined Magnolia Village. In addition to seasonal fruits and veggies, you’ll find sweet & savory pies, fresh bread, flowers, and more!

Saturdays, 10am – 2pm | June 4 – Oct 15, 2022 + Harvest Market on Nov 19, 2022

W McGraw St & 33rd Ave W | Seattle

seattlefarmersmarkets.org/mfm

Photo courtesy of pinterest.com

Phinney

A popular gathering spot for both the Phinney Ridge and Greenwood communities, this market is right next door to a playground and offers live music in addition to the great mix of fresh produce and prepared food.

Fridays, 3pm – 7pm | June 3 – Sept 30, 2022

6761 Phinney Ave N | Seattle

seattlefarmersmarkets.org/pfm

Photo courtesy of wikipedia.org

Pike Place

No introduction needed…make it a day with great restaurants, eateries and retail shops, too.

Daily, 9am – 6pm | Year-Round (Closed Thanksgiving & Christmas)

Pike Place between Pine & Virginia St | Seattle

(206) 682-7453

pikeplacemarket.org

Photo by Daniel Schwen

Queen Anne

Seattle’s only independent farmers market, offering food, chef demos, live music, and children’s activities.

Thursdays, 3pm – 7:30pm | June 2 – Oct 13, 2022 + Harvest Markets on 10/29, 11/19 & 12/17

Queen Anne Ave N & W Crockett St | Seattle

qafm.org

Photo courtesy of qafm.org

Shoreline

Starting this year in their NEW location at the Shoreline Park & Ride, this market offers kids’ programs and live music in addition to its fresh Washington produce, organic meats, bread, honey, and prepared foods. Check out the schedule for info about vendors and entertainment.

Saturdays, 10am – 2pm | June 4 – Oct 1, 2022 + Harvest Markets on 10/29 & 12/17

18821 Aurora Ave N | Shoreline

shorelinefarmersmarket.org

Photo courtesy of www.shorelineareanews.com

University District

Seattle’s only independent farmers market, offering food, chef demos, live music, and children’s activities.

Saturdays, 9am – 2pm | Year-Round

University Way NE (the “Ave”) between 50th & 52nd | Seattle

seattlefarmersmarkets.org/udfm

Photo courtesy of pinterest.com

Wallingford

Located in Meridian Park, you can shop with the whole fam and then enjoy a picnic or playtime at the award-winning playground.

Wednesdays, 3pm – 7pm | May 25 – Sept 28, 2022

4800 Meridian Ave N | Seattle

sfmamarkets.com/visit-wallingford-farmers-market/

Photo courtesy of sfmamarkets.com

West Seattle

A South Seattle weekend destination, this market is set in the vibrant West Seattle Junction and features up to 70 vendors during the summertime peak. Great community atmosphere celebrating Washington grown food and ingredients.

Sundays, 10am – 2pm | Year-Round

California Ave SW & SW Alaska | Seattle

seattlefarmersmarkets.org/wsfm

Photo courtesy of westseattleblog.com

Greater Eastside

Bellevue – Crossroads

East Bellevue’s market features fruits, veggies & dairy products from Washington state farms along with handmade soaps, candles, greeting cards, herbal wellness products, and more. Don’t missed the locally roasted coffee and handmade ice cream sandwiches, too!

Tuesdays, 12pm – 6pm | June 7 – Sept 27, 2022

15600 NE 8th St | Bellevue

https://crossroadsbellevue.com/music-events/crossroads-farmers-market/

Photo courtesy of crossroadsbellevue.com

Bellevue – Downtown

Set in the heart of Downtown Bellevue, this market offers goods exclusively produced within Washington state—from seasonal fruits & veggies to flowers, fresh meats, artisan goods, and prepared cuisine. The Kids’ POP club empowers kids to know where their food comes from and make healthy eating choices.

Thursdays, 3pm – 7pm | May 12 – Oct 6, 2022

Harvest Markets: 10am – 2pm on Sat, 10/15; Sat, 11/19; & Sat, 12/17

1717 Bellevue Way NE | Bellevue

bellevuefarmersmarket.org

Photo courtesy of eatbellevue.com

Carnation

Set in the heart of the Sno-Valley farming district, you’ll find plenty of freshly picked produce along with live music and educational activities for the kids.

Tuesdays, 3pm – 7pm | June, July & August 2022

Bird St & Stossel Ave | Carnation

carnationfarmersmarket.org

Photo courtesy of carnationfarmersmarket.org

Duvall

Nestled alongside the scenic Snoqualmie River, this friendly market features local eggs, jams, fresh roasted coffee, arts, crafts, and baked goods in addition to the seasonal veggies, fruits, and plant starts. Live music, picnic shelters and a playground make this a fun family destination.

Thursday, 3pm – 7pm | May 5 – October 13, 2022

Taylor Landing at 16201 Main St NE | Duvall

duvallfarmersmarket.org

Photo courtesy of duvallfarmersmarket.org

Issaquah

Located at the historic Pickering Barn, this picturesque venue offers a variety of fresh farm and food-based products, concessions, and local artisans.

Saturdays, 9am – 2pm | May 7 – Sept 24, 2022

1730 10th Ave NW | Issaquah

www.issaquahwa.gov/778/Farmers-Market

Photo by Saifu Angto, courtesy of google.com

Kirkland – Downtown

This stunning setting on the Lake Washington shoreline turns shopping into a day at the beach. Peruse local produce and goods, then go for a swim or stroll along Moss Bay. Perfect for a picnic, too!

Wednesdays, 3pm – 7pm | June – September, 2022

Marina Park, 25 Lakeshore Plaza | Kirkland

kirklandmarket.org

Photo courtesy of kirklandmarket.org

Kirkland – Juanita

Set in beautiful Juanita Beach Park on Lake Washington, you’ll find as many as 30 vendors offering farm fresh local produce, herbs, honey, nuts, flowers, plants, baked good, handcrafted items, and prepared cuisine. Make it a date with live music and a picnic at the beach. There’s a great playground for the kids, too.

Fridays, 3pm – 7pm | June – Sept, 2022

Juanita Beach Park, 9703 NE Juanita Dr | Kirkland

www.kirklandwa.gov

Photo courtesy of yelp.com

Mercer Island

Our office is so proud to sponsor this year’s Mercer Island Farmers Market! Come on down for quality local Washington state produce, cheese, fish, meat, bread, and more. Check out the live music schedule, too!

Sundays, 10am – 3pm | June – Sept, 2022

7700 SE 32nd St | Mercer Island

www.mifarmersmarket.org

Photo courtesy of www.mifarmersmarket.org

North Bend

This relaxed market enjoys live music and a spectacular Mount Si view. Vendors offer fresh produce, berries, honey, flowers, baked goods, hand-crafted items, and delicious prepared foods. Two playgrounds plus play fields and a covered picnic shelter make this a fun hangout spot. Leashed pets are welcome, too!

Thursdays, 4pm – 8pm | June 9 – Sept 8, 2022

Si View Park, 400 SE Orchard Dr | North Bend

www.siviewpark.org/farmers-market.phtml

Photo courtesy of thequiltingdoberman.blogspot.com

Redmond

Going strong since 1976, the Redmond Saturday Market offers a huge selection of vendors and dazzling array of produce, flowers, cheeses, preserves, salmon, tea, and handmade goods such as pottery and soaps. You’ll love the ready-to-eat foods, too.

Saturdays, 9am – 2pm | May 7 – Oct 29, 2022

9900 Willows Rd | Redmond

www.redmondsaturdaymarket.org

Photo by Jeff, courtesy of google.com

Renton

Find exclusively Washington-produced fruits, veggies, handmade goods, arts, crafts and more right in the heart of downtown Renton at Piazza Park. Food trucks, live music, and kids’ activities such as the “Healthy Kids Corner” make this a fun spot to liven up your Tuesday.

Tuesdays, 3pm – 7pm | June – Sept, 2022

Piazza Park, 233 Burnett Ave. S | Renton

www.rentonfarmersmarket.com

Photo courtesy of yelp.com

Sammamish

Each Wednesday, the Sammamish Commons plays host to a variety of local farmers, nurseries, bakeries, artisans, food vendors, and more. Live music and kids’ activities, too!

Wednesdays, 4pm – 8pm | May – Sept, 2022

Sammamish Commons, 801 228 Ave SE | Sammamish

www.sammamishfarmersmarket.org

Photo courtesy of sammamishfarmersmarket.org

Woodinville

New location this year! Come check out downtown Woodinville’s newly renovated Schoolhouse District and find produce grown in the state of Washington (and picked fresh for that morning!). You’ll also have an array of boutique baked goods, sauces, cider, artisans, and more to peruse. Check out the calendar for live entertainment, music, demos, and other activities.

Saturdays, 10am – 3pm | May – Sept, 2022

13205 NE 175th St | Woodinville

woodinvillefarmersmarket.com

Photo courtesy of woodinvillefarmersmarket.com

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2022, Windermere Real Estate/Mercer Island.

How’s the Market? Q1 Real Estate Review

Across the region, home values continued to see huge year-over-year gains from 2021 to 2022. Most homes sold in the first 10 days and for well above the asking price. We started the year with an extreme shortage of homes for sale, resulting in an overall lower number of sales compared to the start of 2021. Buyer demand, however, remains incredibly strong.

With interest rates on the rise, buyers are feeling more pressure than ever to secure a home. We are hoping to see more listings come to market this spring and provide some much needed relief for weary house hunters.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

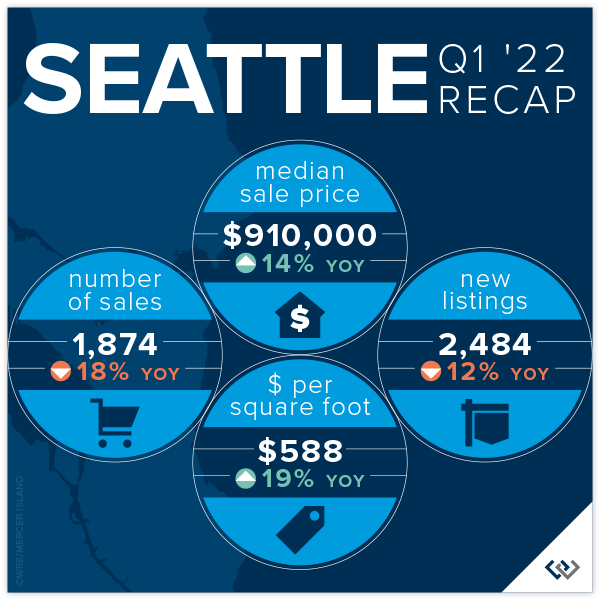

SEATTLE

The Seattle real estate market for single family homes is off and running! The median sale price is up 6% since the end of 2021. Which means: Seattle’s price gains were as much in the first quarter as all of 2021. Year over year, the median price rose from $800,000 in Q1 2021 to $910,000 in Q1 2022.

For anyone who has focused their home search on the Eastside and has come up empty handed in 2021, Seattle could seem like an affordable opportunity this year. Seattle’s price gains were strong, albeit conservative in comparison with the Eastside. More plentiful active inventory (relatively speaking), and a more affordable median sale price of $910,000 (vs $1,625,000 on the Eastside) indicate that Seattle could be a bright spot of hope for any buyers left behind by the Eastside’s double-digit gains.

Rising interest rates in late Q1 are sure to play a part in the weary home buyer’s decision-making process. However, the close of quarter numbers are encouraging: 82% of homes sold in the first ten days!

Click here for the full report and neighborhood-by-neighborhood statistics!

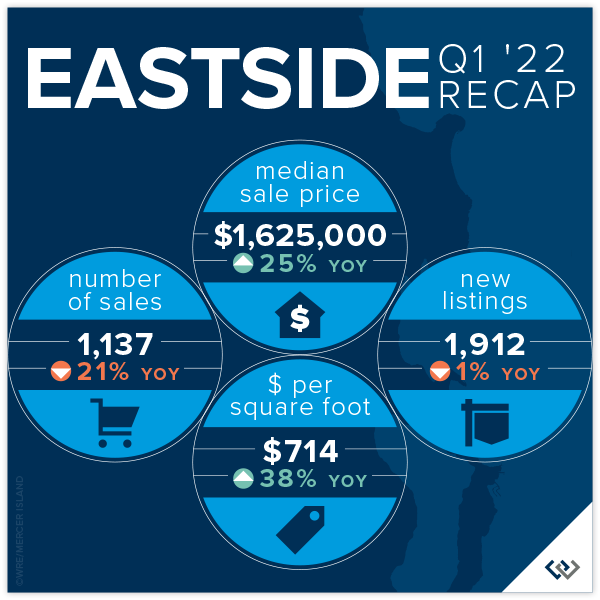

EASTSIDE

Once again Eastside Real Estate is off to an incredible start in the first 3 months of the year. Multiple offers and wildly aggressive escalation clauses are the story of the day, and not just anecdotally—the numbers don’t lie. The average list to sale price ratio was a staggering 119%, which means the typical home listed at $1,000,000 sold for closer to $1,190,000. This is an even stronger showing than the previous record high of 112% in Q1 of 2021.

New listings were relatively flat compared to Q1 of 2020 and 2021 (1912 vs 2058 and 1935 respectively) while the total number of sales were down 21% (1137 vs 1413 in the prior year). We believe this can be explained by looking at the trailing inventory from the previous Q4 in both cases (1496 vs 1238). There were just fewer homes for sale, certainly not less demand. This was reflected in the overall price gain of 25%!

Without a crystal ball it will be tough to tell exactly how much impact the market will feel from the steep rise in interest rates. In the short term, everyone seems to be taking a deep breath as we move into Q2. Overall, the Eastside’s core values—highly ranked schools, community focused neighborhoods, and close commute proximity to some of the area’s largest employers—should keep the area in high demand!

Click here for the full report and neighborhood-by-neighborhood statistics!

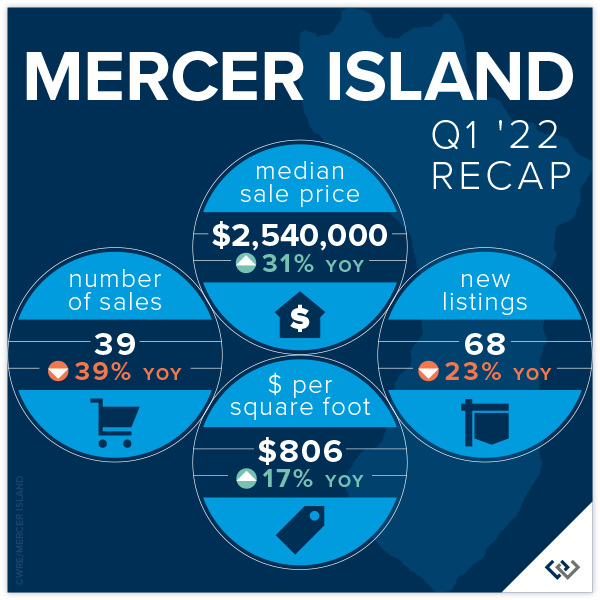

MERCER ISLAND

Mercer Island by the averages was quite shocking in Q1 of 2022: 3 homes per sale per week, 11 days on market, and 111% list price to sale price. This translates to buyers who would have otherwise joined our community casting a wider net to places like Bellevue, Issaquah, and Sammamish.

One of the affordability indicators that we historically track has become obsolete over the past few quarters: number of homes listed/sold under $1,000,000. In fact, there was only one home listed under $1,500,000 in Q1. 21 of the 39 homes had sale prices above $2,000,000 and 9 were above $3,000,000!

If you’re a buyer trying to break into the Mercer Island market, patience and the ability to act fast are the top two tips we have for you. 85% of the 39 homes for sale in Q1 sold within the first 10 days. Working with a local pro will be your biggest advantage.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Condos continue to gain ground early in 2022. While the year-over-year median price gains are conservative compared to the single-family market, we see this as a good thing! Condos are a bright spot for today’s home buyers as interest rates rise.

Seattle condos saw a 9% increase (to $519,000). Eastside condos are up 16% (to $625,000) a 26% lift in price per square foot compared to Q1 2021.

Shoreline and East Bellevue led the market in median price gains year over year, up 66% and 48% respectively. Queen Anne and Kirkland were the most conservative with 1% and 4% gains respectively. 85% of Eastside condos sold over the list price, so if you’re shopping be prepared to compete.

Check out area-by-area details the full condo report.

WATERFRONT

If the first three months are any indication, it will be a tight inventory year in the Waterfront real estate market. On all shorelines, there were a total of 17 homes sold overall with an average of only 6 listings for sale at any one time. The good news is that we’re up from this time last year when there were only 14 homes sold overall.

Notably, the highest overall sale (at $12,750,000) was on Lake Sammamish in Issaquah! The most affordable waterfront this quarter was a home in Rainier Beach that sold for $1,362,500.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis provided by a savvy broker with years of local waterfront experience.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2022, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and deemed accurate but not guaranteed.

How’s the Market? Annual Report on Seattle Area Real Estate…

In the wake of extreme buyer demand and mind-blowing bidding wars, housing prices soared in Seattle and reached staggering heights on the Eastside. Record low interest rates were the silver lining for those buyers who were able to successfully purchase a home with financing.

2022 looks to be another strong year for real estate. Windermere’s chief economist, Matthew Gardner, predicts that interest rates will remain low and home price growth will continue—albeit at a slower, more sustainable rate than we saw in 2021. He also foresees a nice bounce back for our COVID-impacted economy in Q4 of 2022.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

The Seattle real estate market, while extremely active in its own right, was far more moderate than the Eastside’s frenzied and nearly unattainable environment.

Seattle’s Median Sale Price increased by 9% to $852,000 (up from $785,000 in 2020). Neighborhoods in Lake Forest Park-Kenmore (+24%) and Shoreline (+16%) outperformed the average, while Queen Anne-Magnolia (+4%) and West Seattle (+7%) lagged behind.

Despite the tight supply of homes for sale, there was a 20% increase in the number of Seattle homes sold in 2021 (11,589) compared to 9,682 sold in 2020. Central Seattle (+31%) and Queen Anne-Magnolia (+22%) had the largest increases in number of homes sold.

79% of all Seattle homes, and 24% of those priced above $1 million, sold at or above the list price.

Homes that sold in their first ten days on the market went for an average of 7% above list price, compared to 4% over if we look at the overall average. The most competitive neighborhoods were North Seattle and Lake Forest Park, with first-ten-day sales averaging 10% above list price.

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

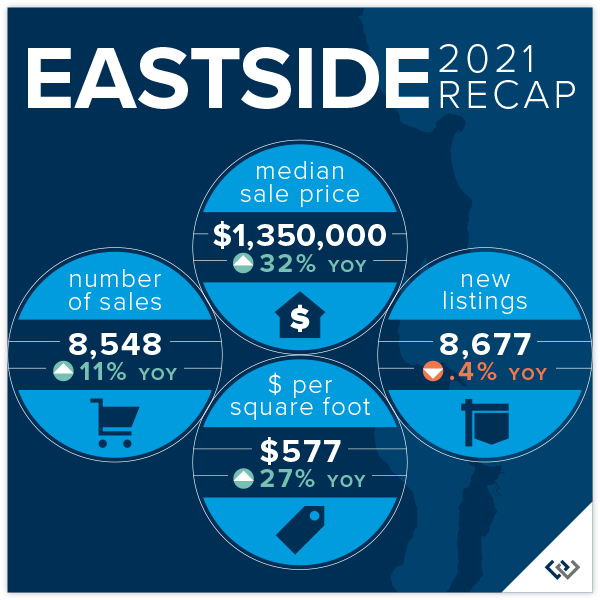

To say the 2021 Eastside real estate market was aggressive would be the understatement of the year. Typical home buyers requiring loans to finance their purchases found it nearly impossible to compete with the many cash or cash-equivalent, no contingency offers that often won out. With few exceptions, home buyers had to be willing to sacrifice rights and fail safes—such as inspection contingencies—that are normally taken for granted in a balanced market.

The Eastside’s Median Sale Price was $1,350,000 in 2021, up an unprecedented 32% over 2020 ($1,020,000) as desperately competing buyers drove prices to record levels. Redmond (+38%) and South Eastside (+36%) saw the largest gains, while West Bellevue (+25%) had the lowest—albeit still staggering—year-over-year increase.

89% of all Eastside homes, and 66% of homes priced above one million dollars, sold for at or above their list price. With fewer than 0.3 Months of Inventory (the number of months it would take to sell all homes currently for sale), the entire Eastside market remained ultra-competitive throughout the year. Many Eastside communities have had only a handful of homes for sale at any one time.

Homes sold an average of 7% above list price. For those sold within the first ten days, however, that number spiked to an average of 11% above list price. The most competitive neighborhoods were East Bellevue and South Eastside, with first—ten-day sales averaging 14% and 13% above list price, respectively.

Click here for the full report and neighborhood-by-neighborhood statistics!

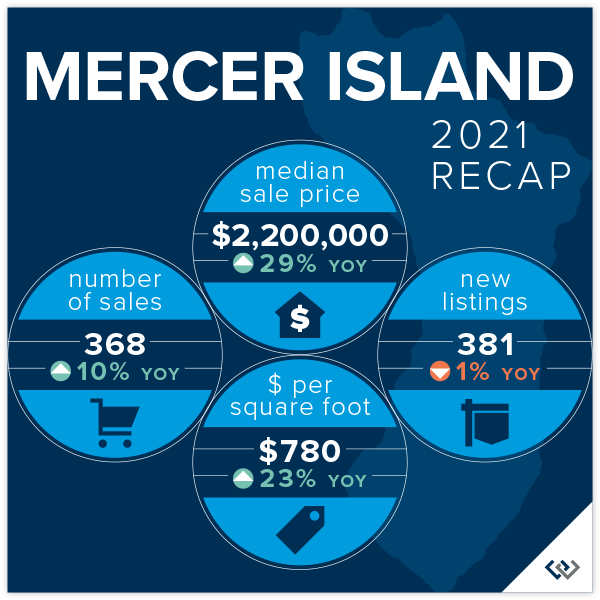

MERCER ISLAND

Fewer than two dozen homes for sale on the Island at any given time in 2021 led to a continued ultra-competitive market. Waterfront, in particular, saw very steep increases during the year as the laws of supply and demand deftly governed prices.

Echoing the extreme price increases seen throughout the Eastside, Mercer Island’s Median Sale Price shot up by a staggering 29% over the last year. It’s worth noting, however, that this number was skewed upward by the unusually high number of luxury waterfront sales.

In 2021, 82% of all homes sold at or above their listed price. Those sold in the first 10 days on market closed for an average of 10% above their list price. On the other hand, homes on the market 11-30 days sold for an average of 2% below their list price list and homes on the market longer than 30 days sold for an average of 6% below their list price.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Seattle condos saw a Median Sale Price increase of 2% (to $490,000) and Eastside condos saw a 5% increase (to $550,000) in 2021. 46% of Seattle condos and 67% of Eastside condos sold in the first ten days on the market.

60% of Seattle condos and 77% of Eastside condos sold at or above their listed price. Those sold in the first 10 days on the market went for an average of 2% and 5% above their list price, respectively.

On the Seattle side, Shoreline condos saw a 43% increase—and on the Eastside, Sammamish and Redmond condos saw a 20% increase—in Median Sale Price driven by both new construction and buyer demand. West Bellevue saw an 18% decrease due to the lack of significant new construction following the debut of luxury new construction in 2020.

Check out area-by-area details the full condo report.

WATERFRONT

There were 170 privately-owned waterfront home sales in the greater Seattle-Eastside region in 2021 (Eastside 59; Seattle 48; Lake Sammamish 36; Mercer Island 27).

The waterfront home market continues to see incredible buyer demand coupled with an extreme shortage of available waterfront homes for sale. As an indicator of demand in the luxury segment, most homes sold near to or above their list price with few outliers—something that historically has rarely happened in this sector.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis provided by a savvy broker with years of local waterfront experience.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2022, Windermere Real Estate/Mercer Island.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link